Introduction:

Protecting your biggest investment – your home – is crucial. Standard Home Insurance 2024 policies offer a vital safety net against unforeseen events. This comprehensive guide delves into the specifics of what a typical Home insurance coverage 2024 policy typically covers, including the latest updates. We’ll explore a range of topics, from dwelling coverage to liability protection and even natural disaster insurance coverage. Understanding your homeowner’s policy is key to securing your financial future and peace of mind.

Understanding the Fundamentals of Home Insurance Coverage in 2024

A standard home insurance policy in 2024 is designed to shield you from various risks. It’s essentially a contract that promises to compensate you for specific losses to your home and its contents. However, what exactly does home insurance cover?

Key Types of Home Insurance Coverage 2024:

Home insurance policies typically combine several crucial coverage components. Understanding these elements directly impacts your decision-making process.

- Dwelling Coverage: This covers the cost of rebuilding or repairing your home following a covered event, like a fire or storm. This is often the largest part of any home insurance policy. It usually accounts for the structure itself but might differ depending on the specifics of your policy.

- Personal Property Coverage: The policy will typically cover your belongings inside your home. Think furniture, appliances, clothing, and other valuable items. Coverage amounts often depend on the assessed value of your possessions declared to the insurance company.

- Liability Coverage: This aspect of your Home insurance policy protects you if someone gets injured on your property or suffers damage to their belongings. Common coverage scenarios include accidents or incidents where a visitor is injured during a party at your home.

- Additional Living Expenses: In the event of a covered damage that makes your home unlivable, this section compensates for temporary lodging, meals, and other expenses you incur while repairs are ongoing.

Deeper Dive into Important Coverages:

- Fire and Theft Insurance 2024: This is a fundamental component, safeguarding against the damage caused by fire and theft. Most standard policies provide coverage on this.

- Natural Disaster Insurance Coverage (2024): The role of natural disasters is a critical part of modern home insurance. Policies usually provide coverage for events such as floods, earthquakes, and severe storms. Factors like your location and property value affect the specifics of what’s included in your policy’s coverage.

- Home Insurance Exclusions 2024: It’s vital to understand the exclusions outlined in your policies and the potential gaps. Many policies specifically exclude coverage for certain events or situations; this could include pre-existing damage or wear and tear. An important step is to review carefully the policy’s exclusions before assuming everything is covered!

How Home Insurance Policy Updates in 2024 Affect Your Coverage:

Home insurance policy updates in 2024 are often influenced by factors like rising construction costs, updated building codes, and the increasing frequency of severe weather events. For example, the coverage for earthquake damage varies significantly by region and might require additional clauses.

What’s Excluded from Standard Home Insurance?

While standard home insurance provides substantial protection, several situations aren’t typically covered. Certain exclusions are essential to be aware of when evaluating a home insurance policy. Examples of common exclusions include:

- Pre-existing damage: Damage to your home that existed before you took out the policy is often not covered.

- Wear and tear: Gradual wear and tear isn’t typically covered.

- Water damage not from a covered event: Certain water damage situations, like plumbing leaks from faulty equipment not related to a covered disaster, often fall outside the scope of standard coverage.

- Damage from war or criminal acts of terrorism: While some policies may include broader coverage, intentional acts of vandalism often fall outside the standard policy’s protection.

Understanding Home Insurance Liability Coverage 2024:

Liability coverage is a crucial element of any homeowner’s insurance policy. If someone is injured on your property, or if damage occurs to someone else’s property, liability protection could provide a vital financial shield. A key aspect of liability coverage is its potential to protect your financial well-being in such unfortunate situations. Understanding the coverage limits and stipulations is vital.

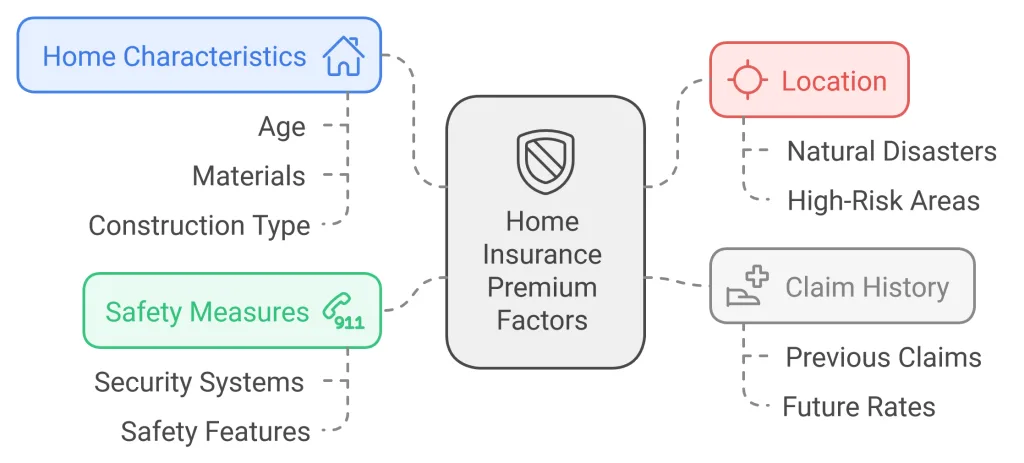

Factors Affecting Your Home Insurance Premium:

Several factors impact the cost of your home insurance, including:

- Location: High-risk areas often have higher premiums due to increased vulnerability to natural disasters.

- Home characteristics: A home’s age, materials, and construction type can affect its vulnerability and insurance cost.

- Claim history: Previous claims against your property will likely impact future insurance rates.

- Safety measures: Security systems and other safety features can sometimes result in lower premiums.

Finding the Best Home Insurance Policy 2024:

The “best” home insurance policy for you depends on your unique circumstances. Consider these factors when researching different policies:

- Policy limits: Review the policy amounts to validate coverage adequacy for your home and belongings.

- Deductibles: Understand the amount you’ll pay out-of-pocket before the insurance company steps in with coverage.

Comparative Analysis of Different Home Insurance Policies:

It’s often beneficial to compare different policies, considering their unique features and stipulations. Factors like exclusions, specific coverage amounts, and potential supplementary services could alter the policies’ effectiveness and value.

Conclusion:

Navigating the world of home insurance can seem complex. We believe this detailed 2024 guide can empower you with the necessary understanding to find suitable insurance. It’s crucial to thoroughly review all policy specifics and obtain more information from your insurance agent. A comprehensive understanding of what’s covered in your home insurance policy is vital for your financial well-being and peace of mind. Contacting an insurance professional for personalized advice is always recommended. Ultimately, having appropriate insurance safeguards your property and protects your financial future.

Frequently Asked Question

What is the basic coverage in a standard home insurance policy for 2024?

A standard home insurance policy typically covers the dwelling, personal property, liability, and additional living expenses.

Are the costs of home repairs covered by standard home insurance in 2024?

Repairs due to covered losses can be covered under the terms of your insurance as laid out in the policy document.

How does home insurance coverage handle natural disasters in 2024?

Coverage for natural disasters may vary, and often, you’ll need to review exclusion clauses for covered incidents to understand the extent to which your policy extends.

What happens if I exceed my policy’s coverage limits in a covered incident?

Exceeding coverage limits in a covered incident might leave you responsible for paying out of pocket for the exceeding cost.

What are some common home insurance exclusions in 2024?

Common exclusions include wear and tear, intentional acts, war incidents, and pre-existing damage.

How can I find the best home insurance policy in 2024?

Thorough research into different providers and their policies, carefully comparing and contrasting their terms, is a valuable step toward finding the optimal option.

What factors affect the costs of home insurance policies?

Factors like location, home design, and safety features can significantly influence the premium charged.

How do I compare different home insurance policies in 2024?

Compare the terms and conditions, including deductibles, coverage limits, and exclusions.

How can I ensure my home insurance policy protects against future risks?

Regularly review your policy and update it as needed to ensure it accurately reflects your current needs.

What are the most critical factors to consider when choosing a home insurance provider in 2024?

Your chosen provider should offer fair coverage at reasonable prices, including considering policy limits, coverage inclusions, exclusions, and current rates.

Need More Details about the Private Medical Insurance? Reach us on our Contact Us page.