Alright, let’s talk about something that may not get your pulse racing like the latest celebrity scandal, but it’s definitely something that keeps a lot of us up at night: company private medical insurance. It’s one of those things that seems straightforward, but—surprise!—it’s as tangled as a bowl of spaghetti. If you’ve ever scratched your head about your company’s private health insurance plan or thought, “Wait, what am I paying for?” then this article is for you. Let’s dive in (oops, scratch that) as we explore some unexpected, and frankly shocking, truths about company medical insurance in the U.S.

1. Your Insurance Plan Is a Maze, and You’re Not Alone in Getting Lost

Let’s start with this bombshell: company health insurance plans are purposely complex. They’re like those “choose your own adventure” books, except with fewer dragons and more paperwork. You see, these plans are full of jargon that leaves most of us feeling like we missed a memo somewhere. “In-network,” “out-of-pocket maximum,” “deductibles”—it’s like they’re speaking another language. And don’t even get me started on “coinsurance.” Isn’t that just a fancy way of saying, “You pay, we pay, let’s all be confused together”?

But the reality is, insurance companies make it this way on purpose. The more confused we are, the less likely we are to fully understand what we’re actually paying for—or not paying for. It’s like going to a restaurant where you’re given a menu in a language you don’t speak, and at the end of the meal, you’re left with a bill that feels way too high. And guess what? No one offers you a free dessert either.

2. Your Boss’s Favorite “Perk” Is Probably a Business Strategy

Ever thought your company’s private medical insurance was a generous benefit? Well, hold up! While it’s true that many businesses offer health insurance to attract and keep talent, there’s a catch: your company gets tax breaks for doing it. So, while you’re thanking your boss for that sweet coverage, they’re busy high-fiving their accountant for all the money they’re saving. Yep, offering private health insurance isn’t purely out of the goodness of their hearts.

And, spoiler alert: the premium your company pays for your insurance is often tax-deductible. That’s why even small businesses get in on the insurance action—it helps them save big while looking like the good guy to you.

3. Your Premiums Aren’t as “Affordable” as You Think

Speaking of premiums, let’s clear something up. You probably think, “Hey, I’m only paying a small portion of the premium, my company’s paying the rest. I’m getting a great deal!” Well, kind of. The reality is, a lot of companies pass on a portion of the premium costs to you over time. Maybe it’s not noticeable at first, but each year, when you get that little letter about changes to your health insurance plan, you’ll notice your share of the cost slowly creeping up.

In fact, some employers might even shift more of the costs onto employees when their overall business expenses rise. It’s like that friend who keeps “forgetting” to pay you back for dinner. Before you know it, you’re shouldering more of the bill than you ever signed up for.

4. That “Network” of Doctors? It’s a Smaller Club Than You Think

Ever notice how you’ve got to stick to a specific list of doctors or hospitals for your insurance to cover anything? This isn’t just a suggestion. Insurance companies negotiate rates with a select group of providers (called a network) to offer you lower prices. But here’s the twist: the network might be a lot smaller than you realize. And no, you can’t just see any doctor or specialist you want. That’s like expecting to walk into a five-star restaurant with a fast food coupon—ain’t gonna happen.

And if you do wander outside your network, brace yourself. Those “out-of-network” bills are enough to make anyone rethink their life choices.

5. Preventive Care Is Free…Until It’s Not

One of the bright spots of company private medical insurance is that it often covers preventive care at 100%. Woohoo! Go get that annual checkup, bloodwork, and flu shot. But here’s the kicker: as soon as your doctor finds something, your wallet might as well start sweating. Sure, that initial exam is “free,” but any follow-up tests, treatments, or medications can quickly drain your bank account. It’s like going to a free concert, only to discover you have to pay for parking, drinks, and—oh look, they’re charging for the bathroom too.

6. You’re Probably Overpaying for Medications

Here’s a fun little fact for you: the price you pay for prescription drugs might be more than what they’d cost without insurance. Wait, what?! That’s right. Due to the way insurance companies negotiate with pharmaceutical companies, your copay for a medication might be higher than if you just walked into a pharmacy and bought the drug outright. It’s a bit like paying more for a bottle of water at an airport than you would at the grocery store—except in this case, no one’s offering free samples.

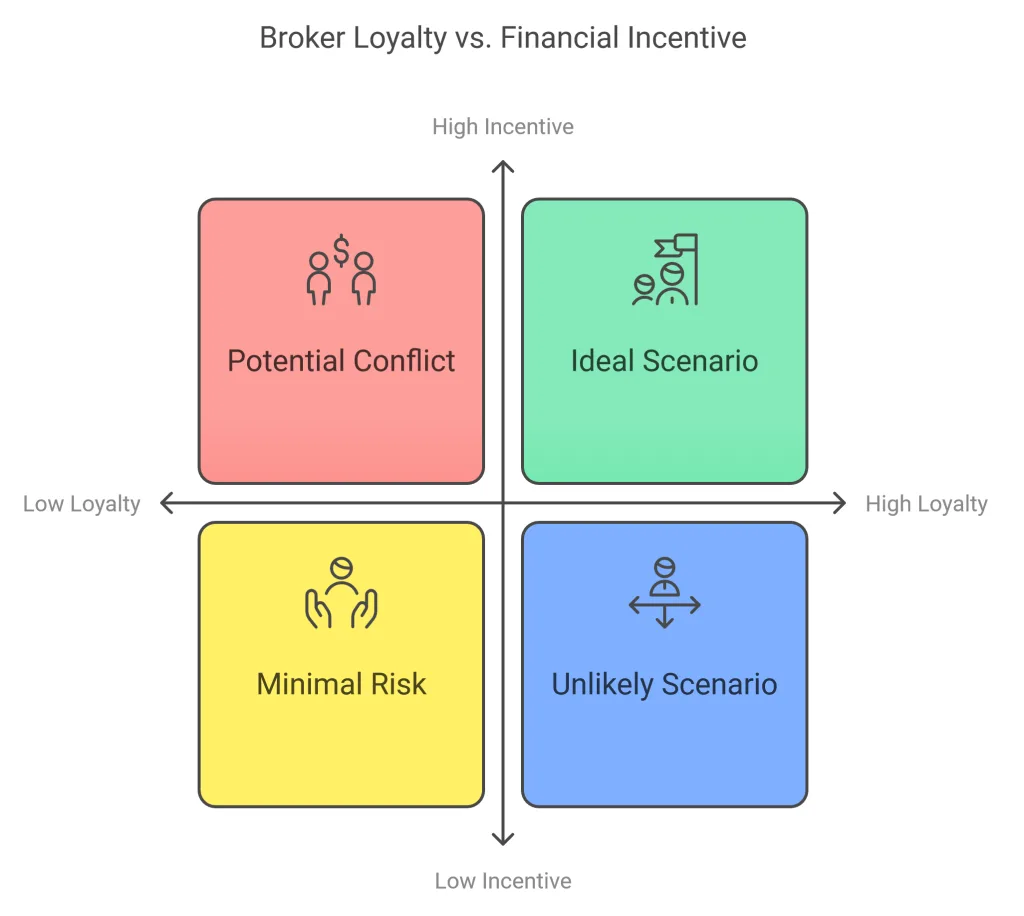

7. Your Health Insurance Broker Is Not Your BFF

If your company uses a broker to find its health insurance plan, don’t be fooled into thinking the broker is on your side. Brokers often work for the insurance companies and get a commission based on the plan they sell to your employer. So, when they’re recommending a plan, they might be thinking more about their paycheck than your well-being. It’s like when a used car salesperson tells you, “This is the car for you,” while silently hoping you don’t notice the strange rattling noise under the hood.

8. “Family Plans” Aren’t as Generous as They Seem

Let’s talk about family plans. Many people assume that adding their spouse and kids to their employer’s health insurance is a good deal. But family private health insurance coverage isn’t always the bargain it appears to be. Adding dependents to your plan can dramatically increase your premiums, and here’s the kicker: some employers don’t even cover a large portion of your family’s health costs.

It’s like thinking you’ve got an all-you-can-eat buffet, only to realize that every plate after the first one costs extra.

9. Mental Health Coverage Can Be a Rollercoaster

Mental health is finally getting the attention it deserves, but insurance companies are still figuring out how to cover it without losing money. So while your company plan might say it includes mental health coverage, getting access to that care might be another story. Sometimes there are strict limits on the number of therapy sessions covered, or you might find that your therapist isn’t “in-network.”

It’s like buying a ticket to a theme park, but once inside, you realize you’ve got to pay extra for every ride.

10. You Can Negotiate—Yes, Really!

Now for the shocker you probably didn’t see coming: you can negotiate your medical bills. I know, it sounds like something out of a movie, but it’s true. Whether you’ve been hit with a surprise bill or just think your copay is ridiculously high, you can call your insurance company or the healthcare provider and haggle. It’s like trying to get a better price at a garage sale—awkward, but totally worth it when it works.

Final Thoughts: Is Private Medical Insurance Really Worth It?

So, there you have it—10 shocking (and slightly disturbing) secrets about company private medical insurance in the USA. At the end of the day, while private health insurance can offer valuable coverage, it’s far from a one-size-fits-all solution. You’ve got to read the fine print, ask questions, and never assume that just because something is part of your benefits package, it’s automatically the best deal. Think of it like buying a used car—kick the tires, ask for a test drive, and be ready to walk away if something doesn’t feel right.

And hey, at least now, the next time you get a bill in the mail that feels more like a slap in the face, you’ll know you’re not alone in the confusion. So go ahead—take charge of your health, your wallet, and your sanity. Who knew adulting could be so…fun?

FAQs about Company Private Medical Insurance in the USA

1. What is company private medical insurance, and how does it work?

Company private medical insurance is a health coverage plan provided by an employer. The company partners with a private health insurance provider to offer coverage to employees, often paying part or all of the premiums. Employees may also have access to family private health insurance options that extend coverage to spouses and dependents. These plans usually include a network of doctors and hospitals, and the insurance helps cover medical expenses like hospital visits, prescriptions, and preventive care.

2. Is company private health insurance better than individual health insurance?

It depends on your personal needs. In many cases, company private medical insurance can offer better rates because employers negotiate group coverage rates with insurance companies. However, individual plans allow more customization. If you’re young and healthy, you may prefer finding a low-cost private health insurance plan on your own, especially if you rarely visit the doctor. On the other hand, company plans are often more affordable for families, with options like family private medical insurance.

3. Can I add my family to my company’s private medical insurance plan?

Yes, most employers offer family private health cover as part of their insurance plans. This allows you to add your spouse and children to your policy, although this will typically increase your monthly premium. The additional cost can be high, so it’s a good idea to compare the private health cover quotes for adding family members versus buying individual coverage.

4. What should I do if my doctor isn’t in my insurance network?

If your doctor is out of network, your options are limited. You can either choose to see a doctor within the plan’s network or pay higher out-of-pocket costs for staying with your current doctor. It’s a good idea to check your private medical plan’s network before signing up, especially if you have a preferred provider. You can also ask your insurance broker for options that have a wider personal health insurance coverage area.

5. How do I find a private health insurance broker near me?

If you’re looking for a private health insurance broker to assist you in finding the right plan, a quick search for personal health insurance brokers near me should yield results. Brokers can help you compare private health insurance quotes, explain your options, and ensure you’re getting the best value for your needs. Be cautious, though, as brokers work on commission, so make sure they are recommending what’s best for you, not just what pays them the most.

6. Does company private health insurance cover international medical expenses?

Not all company health insurance plans offer international private health insurance coverage. If you travel frequently or live abroad, you may need to purchase a separate global private medical insurance policy. These policies cover medical costs incurred outside the U.S., ensuring you’re protected no matter where you are. Some employers may offer an international plan as part of their benefits package, but it’s not standard.

7. Can I buy private medical insurance online if I leave my company?

Yes, if you leave your job and lose your company health insurance, you can easily buy private medical insurance online. Many websites offer private health insurance quotes that allow you to compare different plans and pick one that fits your needs. Look for affordable private health insurance plans if you’re concerned about cost, and make sure the coverage aligns with your health needs.

8. What does preventive care include under company private health insurance?

Preventive care usually covers routine health checkups, screenings, and immunizations aimed at preventing illnesses. Most personal health care insurance plans, including those from employers, cover preventive services at no additional cost to the employee. This could include annual physicals, vaccinations, and routine blood work. However, if any issue is found during these visits, the treatment or follow-up care might come at a cost.

9. Are private health insurance plans expensive for young adults?

Private health insurance costs vary, but young adults typically pay lower premiums due to their lower risk of medical issues. Many employers offer best private health insurance for young adults that includes preventive care and emergency coverage. If you’re in good health, you can also find cheap private health insurance plans through either your company or an individual broker, depending on your needs.

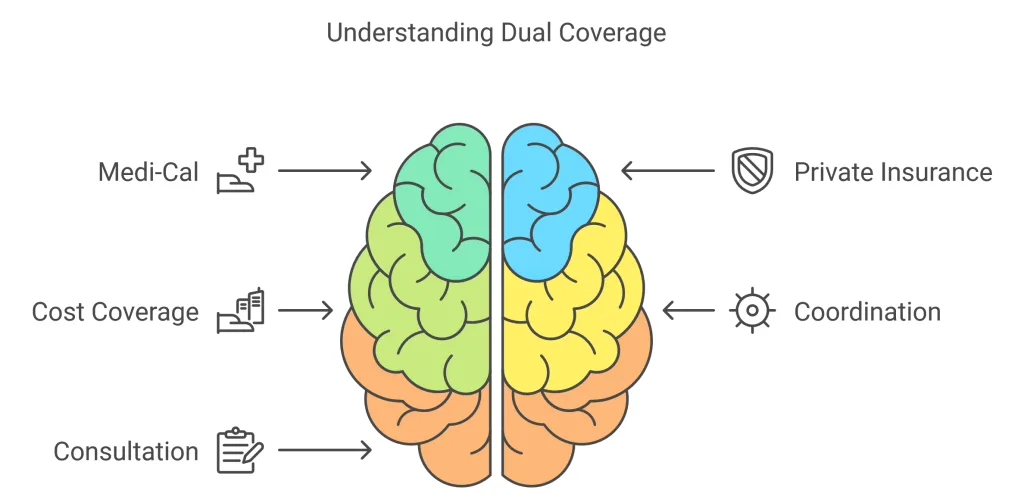

10. Can I use Medi-Cal and private insurance at the same time?

Yes, in some cases, you can have both Medi-Cal and private insurance. This is known as having dual coverage. Medi-Cal may help cover the costs that your private insurance doesn’t, such as deductibles or copays. However, the specific coordination between Medi-Cal and private insurance depends on your situation and the state where you reside. It’s essential to speak with an insurance broker or your HR department to ensure both forms of coverage work together efficiently.

Closing FAQ Section Thought

These FAQs are meant to clear up some common questions about company private medical insurance in the U.S., a topic that can feel like navigating through a jungle with a blindfold. By understanding these nuances, you can make smarter choices about your healthcare—whether you’re sticking with your company’s plan or venturing out to buy private coverage on your own.

Need More Details about the Private Medical Insurance? Reach us on our Contact Us page.