Introduction

We’ve all heard the saying, “Kill two birds with one stone,” but did you know this can apply to your insurance as well? Bundling home and auto insurance is like the ultimate two-for-one deal. Not only does it simplify your life by combining both policies, but it can also save you a pretty penny. That’s right, double the coverage, half the cost—sounds like a win-win, doesn’t it?

If you’re scratching your head wondering how to bundle home and auto insurance or why it’s even a good idea, don’t worry, you’re in the right place. Let’s dive into the nitty-gritty of how this works and why it might be one of the smartest financial decisions you’ll make this year.

What is Bundling Home and Auto Insurance?

Before we get into the juicy benefits, let’s start with the basics. Bundling home and auto insurance simply means combining both your home and car insurance policies with the same provider. Rather than having separate policies for your house and vehicle, you’ll be able to manage them under one umbrella. Sounds simple enough, right? But here’s the kicker—it usually comes with home auto insurance discounts or a multi-policy discount that can save you a significant amount of money.

Why Bundle? The Advantages of Bundling Home and Auto Insurance

Bundling home and auto insurance isn’t just about saving cash—though that’s a pretty big part of it! There are several other advantages to consider when deciding if bundling is right for you.

1. One Stop Shop for Coverage

Let’s face it, dealing with insurance can be a headache. Between policies, paperwork, and bills, managing multiple providers can feel like juggling flaming swords. When you bundle, everything’s under one roof, making it easier to keep track of payments, renewals, and any changes in coverage. It’s the ultimate life hack for busy people who want to simplify without sacrificing quality.

2. Save Some Serious Money

Who doesn’t love saving money? Bundling your home and auto insurance can lead to substantial bundle home auto insurance savings. Insurance companies love it when you bring them more business, so they reward you with a discount for combining your policies. Think of it as their way of saying, “Thanks for sticking with us!” The multi-policy discount for home and auto insurance can add up to hundreds of dollars in savings every year. If you like paying less for great coverage (who doesn’t?), bundling might be a no-brainer.

3. Discounts on Discounts

Some companies don’t stop at offering just one discount. When you bundle, they might throw in extra perks like loyalty discounts or even home and auto bundle discounts. It’s like finding a secret menu at your favorite restaurant. The more you know, the more you save.

4. Streamlined Customer Service

When you bundle, you get the advantage of a unified customer service experience. Instead of bouncing between two different companies and explaining your situation twice, you deal with one provider. Whether you’re filing a claim or asking for a home and auto insurance quote bundle, the process is easier, quicker, and much less of a headache.

5. Easier Claim Process

If disaster strikes and your home and car are both affected—think a nasty hailstorm or a falling tree—it’s a lot easier to file one claim for both damages when your policies are bundled. Plus, when your insurance provider covers both, you’ll only be dealing with one deductible, saving you both time and money. One claim, one provider, one deductible. It’s insurance without the drama.

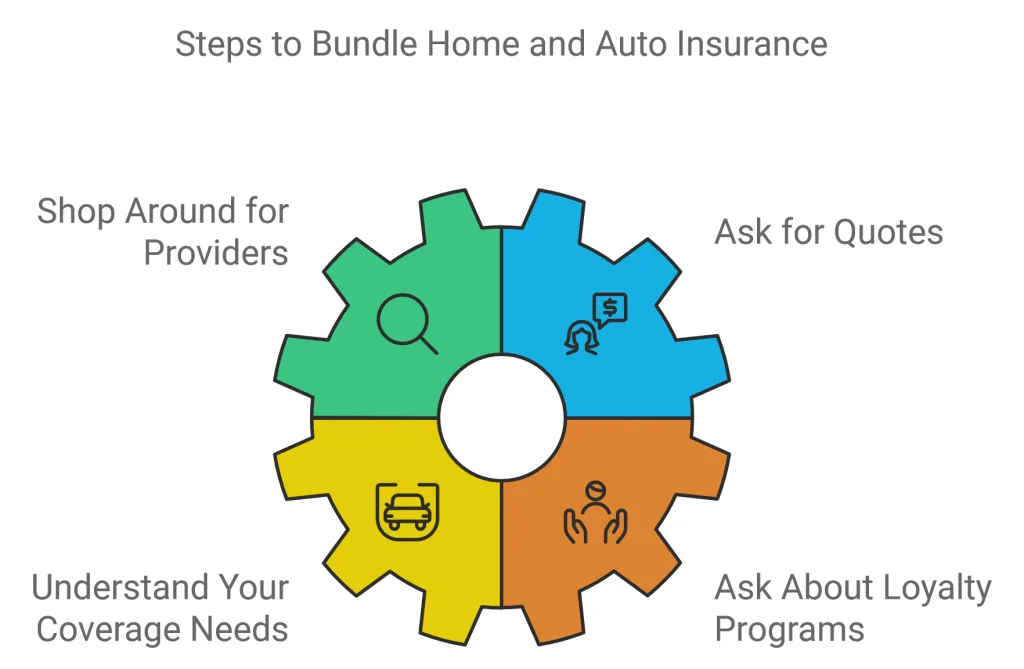

How to Bundle Home and Auto Insurance

Now that you’re on board with bundling, how do you actually go about doing it? Here are some simple steps to help you get started:

1. Shop Around for Providers

Not all insurance companies offer the same deals on home and car insurance packages. Some might offer better discounts than others, or more tailored coverage. It pays to do a little comparison shopping to see which company will offer the best insurance bundle savings. Websites make this easier than ever by allowing you to compare quotes side by side. Look for companies that specialize in cheap home and auto insurance bundles without sacrificing quality.

2. Ask for Quotes

Don’t be shy—get quotes from several providers to see what the best deal is. When you request a home and auto insurance quote bundle, make sure to ask if there are any extra perks or benefits for bundling that might not be obvious upfront. Some providers offer special discounts for new customers or for those switching from another company. And if you’re already insured? Ask your current provider if they can give you a better rate by bundling your policies.

3. Understand Your Coverage Needs

While it might be tempting to go for the cheapest policy, it’s important to make sure that the coverage meets your needs. Take a look at the fine print and make sure your home and auto are adequately protected. You don’t want to end up with a policy that leaves you high and dry when something goes wrong.

4. Ask About Loyalty Programs

Some insurance providers offer loyalty programs or other incentives if you stick with them long-term. It’s worth asking if your provider has any extra goodies for customers who bundle home and auto insurance.

Comparing Home and Auto Bundle Insurance Options

Now that you’ve got a list of potential providers, how do you compare them? Look for key factors like customer service, claims process, and coverage options. You don’t want to sacrifice quality just to save a few bucks. A good rule of thumb is to check out online reviews, see what current customers are saying, and ask around for recommendations.

Make sure to also consider how each provider handles claims. Some companies might offer a combined home and auto insurance coverage claim service that speeds up the process if you need to file for both at the same time. Others might specialize in certain types of claims that are more relevant to your area—like weather-related damages or accidents.

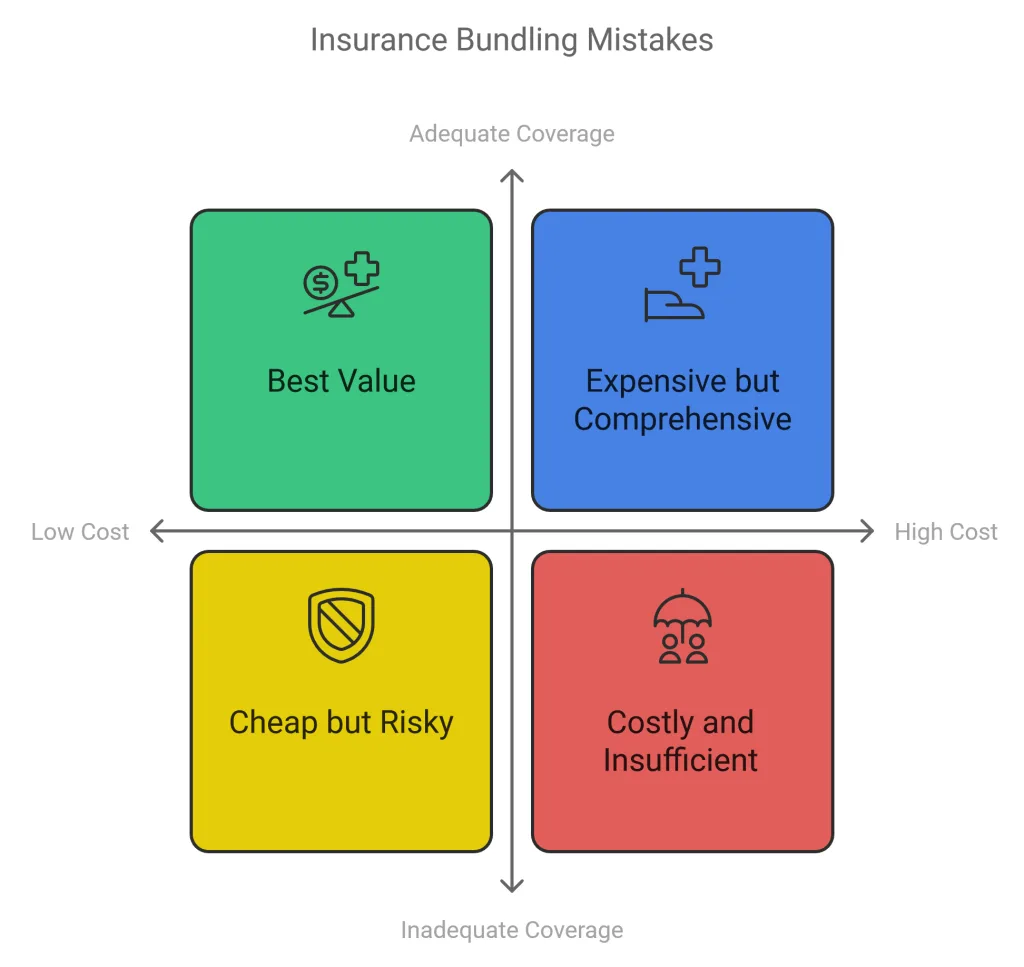

Common Mistakes When Bundling Home and Auto Insurance

While bundling is a great option for many, there are a few mistakes you’ll want to avoid:

1. Not Shopping Around

Don’t settle for the first offer you get. Just like with anything else, it pays to shop around. Comparing home and auto bundle insurance from different providers will help you find the best deal.

2. Ignoring the Fine Print

Always read the details of your policy carefully. Some bundled policies may come with limitations, and you don’t want to be caught off guard in the event of an accident or damage.

3. Over- or Under-Insuring

It’s important to find the right balance between affordability and adequate coverage. While it’s tempting to go for a lower price, make sure that the coverage you choose is enough to protect both your home and vehicle properly.

The Future of Bundling: Why It’s Only Getting Better

As more insurance companies recognize the benefits of bundling for both their customers and their bottom line, the options for home and auto bundle discounts are only getting better. Companies are constantly evolving to offer better packages, more comprehensive joint policy home and auto insurance options, and even easier processes for their clients.

Final Thoughts: Is Bundling Right for You?

At the end of the day, bundling home and auto insurance isn’t just about saving money (although that’s a huge plus!). It’s also about convenience, peace of mind, and simplifying your life. With a dual insurance home and auto policy, you get the best of both worlds—protection for your home and vehicle, all under one roof.

If you want to save money and simplify your life, bundling might be the solution you’ve been looking for. Whether you’re a first-time buyer or a seasoned homeowner, combining your policies could be a game-changer. So, why not give it a try and enjoy the savings that come with bundling? After all, who doesn’t love paying less for more?

FAQs on Bundling Home and Auto Insurance

What is bundling home and auto insurance?

Bundling home and auto insurance means combining your home and car insurance policies under one provider. By doing this, you can often get a multi-policy discount which lowers your overall premiums, leading to insurance bundle savings. It’s a convenient way to manage both types of insurance under a single plan.

How much money can I save by bundling home and auto insurance?

The amount you can save varies depending on the insurance company and your personal situation. On average, customers save between 10% to 25% when they choose a home and auto insurance quote bundle. Some providers may offer even more substantial home auto insurance discounts, especially if you have additional policies like life insurance included.

What are the advantages of bundling home and auto insurance?

The key advantages of bundling home and auto include significant cost savings, easier management of your policies, and simplified claims processing. Additionally, bundling can help you qualify for home and auto bundle discounts, reducing your overall premium while ensuring comprehensive coverage for both your home and vehicle.

Can I bundle other types of insurance with home and auto?

Yes, many insurance providers offer options to bundle other types of insurance, such as life or renters insurance, along with home and auto. This is often referred to as a combined home and auto insurance coverage or a packaged insurance home and vehicle plan. The more policies you bundle, the greater the potential savings.

How do I compare home and auto insurance bundle options?

To compare home and auto bundle insurance options, start by getting quotes from multiple providers. Look at the coverage they offer, the total cost, and any additional discounts available. You should also compare customer service reviews and claims processing efficiency. Ensure that the coverage meets your specific needs before choosing a provider.

Are there any disadvantages to bundling home and auto insurance?

While bundling offers many benefits, it’s not always the best choice for everyone. The potential downside is that if one provider offers great auto insurance rates but not as good home insurance rates, you might end up overpaying for one part of your coverage. It’s essential to evaluate the overall cost and ensure you’re getting the best deal for both policies in a home and car insurance package.

What should I look for when selecting a home and auto insurance bundle?

When selecting a bundle, consider the coverage limits, deductibles, and the level of customer service offered by the insurer. You should also make sure the home and auto bundle discounts are worthwhile and check if the provider has a good reputation for handling claims. Don’t just focus on getting the cheapest home and auto insurance bundle—ensure that both your home and car are adequately protected.

Can I switch insurance companies if I’m already bundling home and auto insurance?

Yes, you can switch insurance companies even if you’re already bundling your policies. However, it’s essential to time the switch properly, so you don’t lose any coverage. You can start by requesting home and auto insurance quote bundles from different providers and compare them to your current plan to see if switching will save you more money.

How do I qualify for home and auto bundle discounts?

To qualify for home and auto bundle discounts, you typically need to purchase both your home and car insurance from the same provider. Some companies may also offer additional discounts if you add other policies, such as life or umbrella insurance. Always check with your insurer to see if there are specific requirements to meet in order to maximize your savings.

Is it better to bundle home and auto insurance, or keep them separate?

For most people, bundling offers the best balance of convenience and savings. The advantages of bundling home and auto include dual insurance home and auto discounts and a simplified claims process. However, if one insurance company provides significantly lower rates for just auto or home insurance, it might make sense to keep them separate. It’s always a good idea to compare options and make sure you’re getting the best deal overall.

Need More Details about the content? Reach us on our Contact Us page.