Introduction

Best Online Car Insurance is a hot topic now! In today’s world, where we can order pizza, find a date, and book a flight with just a few taps on our phones, it’s no surprise that buying car insurance online has become just as easy. But with great convenience comes great confusion. The options seem endless, the fine print seems even finer, and let’s not forget the jargon that makes you feel like you’re decoding some ancient script.

Fear not, dear reader! Whether you’re a seasoned driver looking to switch or a new car owner trying to figure out what all these insurance terms mean, this guide is here to break it all down for you—without making your brain explode. We’re going to cover everything from the basics of car insurance to how to find the best deal online, sprinkle in some laughs, and throw in a few pro tips along the way. Buckle up; this is the only car insurance guide you’ll ever need!

What is Car Insurance?

Alright, let’s start with the basics. Car insurance is essentially your financial safety net in case something goes wrong while you’re out on the road. Think of it as a superhero sidekick that swoops in to save the day when accidents, thefts, or natural disasters happen.

There are several types of car insurance coverage:

- Liability Insurance: This is the big one—it covers damages or injuries you cause to others. It’s like a cushion for your wallet when things go wrong.

- Collision Insurance: If you hit a tree, a pole, or another car, this one’s got your back by covering repairs to your own car.

- Comprehensive Insurance: This covers non-collision events like theft, fire, or even a meteorite hitting your car (hey, it could happen).

- Uninsured/Underinsured Motorist Insurance: Protects you in case someone without insurance decides to play bumper cars with you.

- Personal Injury Protection (PIP): This one covers medical expenses for you and your passengers, regardless of who’s at fault.

A Little Humor Break: The Unwritten Rule of Insurance

Ever noticed that you never seem to need insurance… until you actually don’t have it? That’s Murphy’s Law of car insurance—when you don’t have coverage, the universe decides to throw everything at you. But when you’re fully insured? Well, it’s smooth sailing, my friend.

Why Should You Buy Car Insurance Online?

If you’re like most people, you probably don’t enjoy sitting on hold with an insurance agent for an hour, only to be told to fax in a bunch of forms. (Fax? In this century?) Buying car insurance online is a dream come true for those of us who prefer doing things quickly and painlessly.

Here’s why it’s better to go digital:

- Convenience: Get a quote, compare policies, and sign up for coverage all from your couch—without putting on pants!

- Better Prices: Online platforms often offer discounts that traditional insurers won’t mention. Plus, comparing multiple quotes side by side is easier than ever.

- No Pressure: No pushy agents trying to upsell you. You’re in control.

- 24/7 Access: Had a brilliant idea at 3 a.m. that you need to change your coverage? You can do that online without waking anyone up.

How to Choose the Best Online Car Insurance

Choosing the best online car insurance is like picking out the perfect avocado—tricky, but worth the effort. You want the right balance of coverage and cost, without any hidden surprises waiting inside. Here’s how to find the best option:

1. Understand Your Needs

Before jumping into the pool of insurance options, take a moment to think about what kind of coverage you need. Are you driving a brand-new Tesla, or an old reliable Honda? Do you live in a quiet neighborhood or a city where fender benders happen daily? Knowing your driving habits and needs will help you figure out the type and amount of coverage that makes sense.

2. Compare Quotes from Multiple Companies

Never settle for the first quote you get. Shopping around is key to finding the best deal. You can use comparison sites like The Zebra, Insurify, or Policygenius to pull up quotes from different insurers in one place. It’s like window shopping, but for something way less fun than shoes.

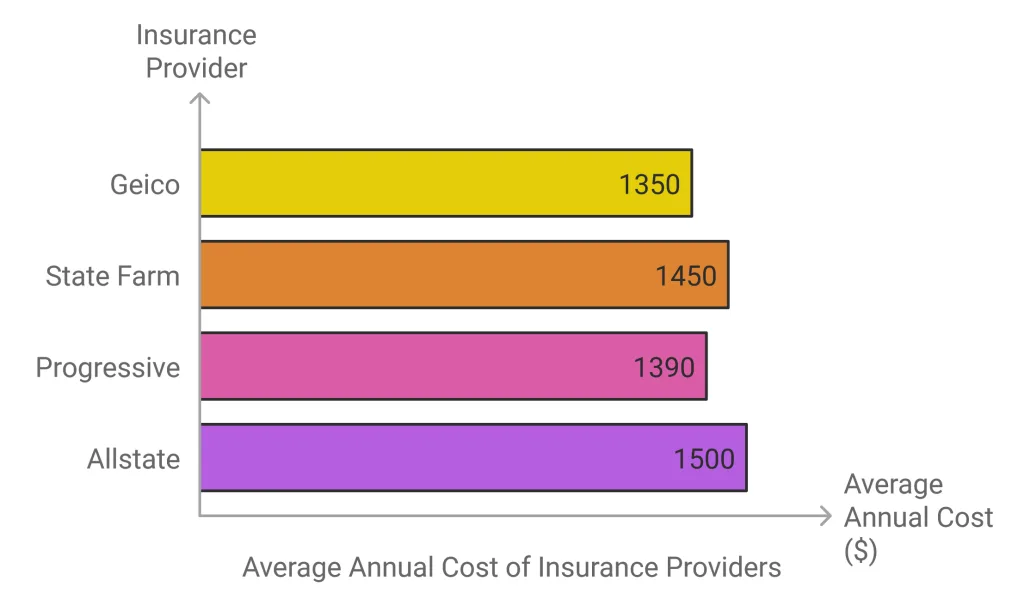

| Insurance Provider | Average Annual Cost | Coverage Options |

|---|---|---|

| Geico | $1,350 | Full Coverage |

| State Farm | $1,450 | Liability, Collision, Comprehensive |

| Progressive | $1,390 | Full Coverage |

| Allstate | $1,500 | Liability, Comprehensive |

3. Check the Discounts

Most insurance companies offer a range of discounts that can shave a significant amount off your premium. These include:

- Safe Driver Discount: If you haven’t been in an accident in years, this one’s for you.

- Multi-Car Discount: Got more than one car? Bundle them together for a discount.

- Good Student Discount: Young drivers with good grades can save a surprising amount of money.

- Pay-in-Full Discount: Pay for your policy upfront and say goodbye to monthly payments (and hello to a discount).

4. Look at Customer Reviews

What good is a cheap insurance policy if the company won’t come through when you need them? Make sure to read reviews and ratings on websites like J.D. Power, Trustpilot, or Google Reviews to see how other customers have rated their experiences.

5. Check the Fine Print

I know it’s boring, but read the policy documents carefully before signing up. Make sure you understand what’s covered, what’s not, and what the deductibles are. It’s better to be informed now than to face a nasty surprise when you file a claim.

Pro Tip:

When comparing policies and looking for the best online car insurance, look beyond just the price. Sometimes a slightly more expensive policy includes extras like rental car coverage or roadside assistance, which can save you money in the long run.

How to Save Money on Car Insurance

Saving money on car insurance is an art form, and I’m about to turn you into Picasso (of insurance, at least). Here’s how to keep more cash in your pocket:

Bundle and Save

If you already have homeowners or renters insurance, bundling it with your car insurance can lead to some sweet discounts. Just make sure the total price is actually lower after bundling, because sometimes those deals can be a bit sneaky.

Raise Your Deductible

A higher deductible (the amount you pay out of pocket in case of a claim) means a lower premium. Just be sure you have enough savings set aside to cover that deductible if an accident does happen.

Drive Less

Many insurers offer lower rates for drivers who don’t rack up a ton of miles. If you work from home or only drive occasionally, mention it! Low mileage equals low risk in the insurance world.

Install Safety Features

If your car has anti-theft devices, airbags, or other safety features, you could be eligible for a discount. Some companies also offer discounts for installing a tracking device that monitors your driving habits (just don’t drive like you’re in a Fast and Furious movie).

Common Myths About Car Insurance

Now that you’re becoming an insurance expert, let’s debunk some common myths that seem to float around:

Myth 1: “Red cars cost more to insure.”

Nope. The color of your car doesn’t affect your insurance rate. So, feel free to get that red convertible—you won’t pay more than your neighbor with a beige minivan.

Myth 2: “Your credit score doesn’t matter.”

Oh, but it does! Many insurers use your credit score as part of their risk assessment. A higher score can actually lower your rates.

Myth 3: “Older cars don’t need full coverage.”

It depends on the car’s value. If it’s worth more than what you’d pay out of pocket in an accident, then yes, you probably still need comprehensive and collision coverage.

Myth 4: “Insurance follows the driver, not the car.”

In most cases, insurance follows the car, not the person driving it. So if your buddy borrows your car and gets into an accident, it’s your insurance that will take the hit.

Conclusion

Buying car insurance doesn’t have to be as complicated as it seems. With the right approach, a bit of research, and the magic of the internet, you can find the perfect policy that suits your needs without breaking the bank.

The key is understanding what coverage you need, comparing your options, and staying on the lookout for those sweet, sweet discounts. Remember, a little bit of homework now can save you a lot of hassle (and cash) later.

So, go ahead—start shopping around, get yourself some quotes, and finally tick “buy car insurance” off your to-do list.

Frequently Asked Questions (FAQ)

1. What is the best website to buy car insurance online?

There are several great websites to compare quotes and buy car insurance, such as The Zebra, Policygenius, and Insurify.

2. How can I lower my car insurance premium?

You can lower your premium by raising your deductible, bundling policies, driving less, and taking advantage of discounts like the safe driver or multi-car discount.

3. Is it safe to buy car insurance online?

Yes, it’s safe as long as you use reputable websites and insurers. Always double-check the legitimacy of the company before making any payments.

4. What type of car insurance do I need?

It depends on your car, driving habits, and budget. Most people need at least liability insurance, but if your car is newer or financed, you might want full coverage.

5. Can I switch my car insurance at any time?

Yes, you can switch car insurance providers anytime. Just make sure you don’t have a gap in coverage when switching.

6. Will my insurance go up if I file a claim?

In most cases, yes. Filing a claim can lead to higher premiums, especially if you’re at fault for an accident.

7. Does car insurance cover rental cars?

Some policies include rental car coverage, but if yours doesn’t, you can usually add it for an extra fee.

8. Do I need insurance if I don’t drive my car?

If your car is sitting unused, you can consider suspending your coverage or switching to a lower-cost option, like comprehensive-only coverage.

9. What’s the difference between comprehensive and collision insurance?

Collision insurance covers damage to your car from a collision with another car or object, while comprehensive insurance covers non-collision events like theft, vandalism, or natural disasters.

10. Is car insurance mandatory?

Yes, in most places, car insurance is mandatory by law. At the very least, you’ll need liability coverage.

Need More Details about the content? Reach us on our Contact Us page.