Let’s talk about life insurance. Yeah, I know, it’s not the most exciting topic, but it’s like eating your vegetables—you may not want to do it, but you know it’s good for you. And while I can’t make vegetables more exciting, I can help you see why term life insurance might just be one of the smartest moves you can make for your family’s future. And no, it’s not as confusing as rocket science. In fact, once you get the hang of it, it’s pretty simple and dare I say, a bit comforting.

Before your eyes glaze over at the thought of insurance talk, stay with me. We’re going to make this easy, maybe even a little fun (yes, insurance and fun in the same sentence), and most importantly, we’ll keep it real. No buzzwords, no confusing jargon, just a straightforward look at how term life insurance can be the safety net your family needs.

What is Term Life Insurance?

Alright, let’s start with the basics. Term life insurance is a type of life insurance that provides coverage for a specific period, or “term,” like 10, 20, or 30 years. If you, well, bite the dust during this time, the death benefit payout goes to your beneficiaries. It’s not complicated, it doesn’t come with investment opportunities, and it doesn’t last forever. It’s like renting an apartment versus buying a house—you’re covered for a certain amount of time, and when that time’s up, you have the option to renew, but the rates will probably go up.

Now, before you think, “Why would I pay for something I might never use?” remember this: insurance is all about protection. It’s not a savings account, it’s not a way to make money, it’s about ensuring your family has financial support if the unthinkable happens.

Think about it this way: you wouldn’t drive without car insurance, right? Term life insurance is like that, except instead of protecting your car, it protects your family’s financial well-being.

Why Choose Term Life Insurance?

Great question! Term life insurance is like the PB&J of the insurance world—classic, reliable, and does exactly what you need it to do without any frills. If you’re wondering why term life insurance is a good idea, here are a few reasons that might make you say, “Hmm, that makes sense.”

1. It’s Affordable

One of the major reasons people opt for term life insurance is because it’s affordable. If you’re looking for a low-cost life insurance option, this is it. You can get a decent amount of coverage without breaking the bank. Think of it like ordering off the dollar menu instead of going to a fancy restaurant—you’re getting exactly what you need for a price that won’t leave you feeling guilty.

2. Simplicity is Key

With term life, you don’t have to deal with complicated cash value in life insurance or fancy investment strategies. It’s as simple as paying your premiums, staying covered for a set period, and giving your loved ones financial security in case of your passing. And when life’s already complicated (hello, bills, kids, jobs, taxes, etc.), sometimes simple is exactly what you need.

3. Flexible Coverage Options

Need coverage for the next 10 years while your kids are still young? Done. Want to make sure you’re covered until your mortgage is paid off in 30 years? You got it. The coverage options for term life are as flexible as your Netflix binge schedule. Whether you need a shorter or longer term, you can customize the policy to fit your life’s needs.

4. It Gives You Peace of Mind

We all know life is unpredictable (who saw the whole 2020 thing coming?). Term life insurance gives you peace of mind knowing that if something were to happen, your family won’t be left scrambling to cover bills, mortgage payments, or other expenses. It’s not just about you—it’s about ensuring your loved ones are financially secure even when you’re not around.

Term vs Whole Life Insurance: What’s the Difference?

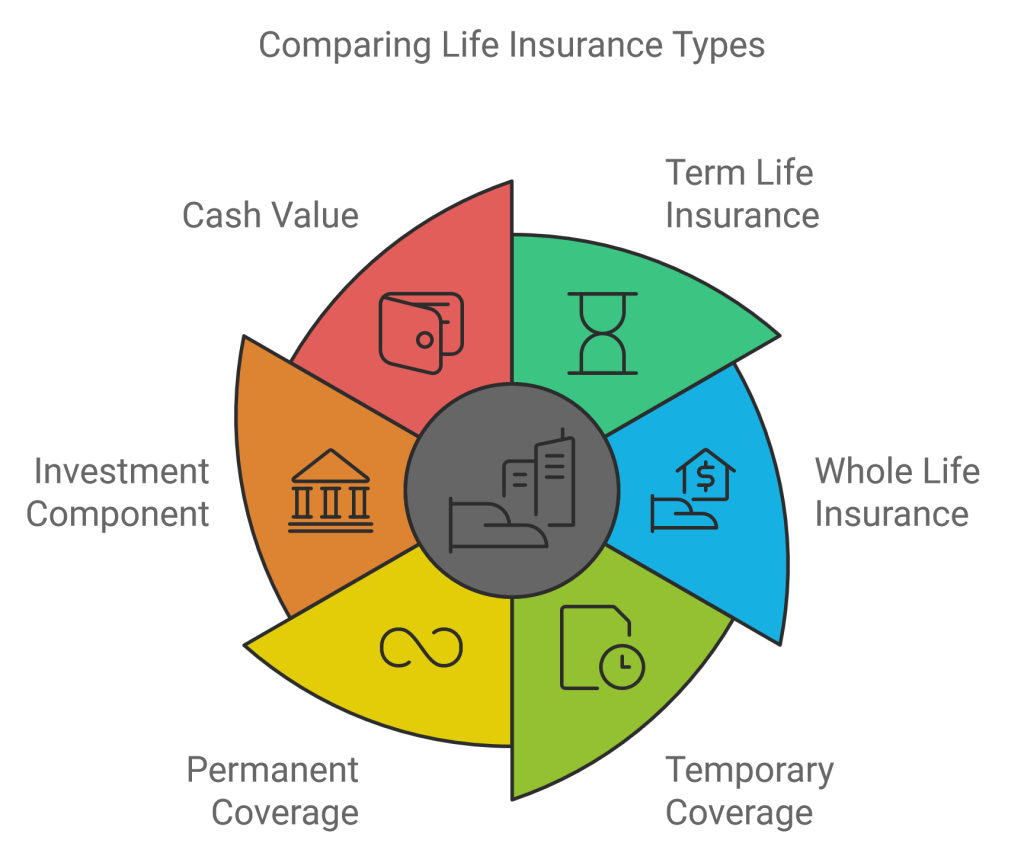

Now, if you’re comparing term vs whole life insurance, it’s like deciding between renting a house or buying one. Term life is temporary—lasting for a specific number of years—while whole life insurance is, you guessed it, for your whole life. Whole life also has an investment component, where part of your premium goes into building a cash value that you can borrow against or withdraw.

Whole life sounds fancy, right? But here’s the catch—it’s a lot more expensive. You’re paying for coverage, plus that investment. And while having a cash value in life insurance sounds nice, it’s not always the best option for everyone. Most people just need a simple, straightforward life insurance plan that provides protection when they need it most.

Let’s break it down even more:

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Duration | Specific term (e.g., 10, 20, 30 years) | Lifetime coverage |

| Premiums | Lower, more affordable | Higher premiums |

| Cash Value | None | Builds cash value over time |

| Best For | Shorter-term needs (raising kids, paying off debt) | Long-term coverage and investment |

Pros and Cons of Term Life Insurance

Alright, so what are the pros and cons of term life insurance? Let’s get into it.

Pros

- Affordable premiums: Like I mentioned earlier, term life is cheaper than whole life. You’re paying for what you need without the extra fluff.

- Simple coverage: No fancy investment components or savings accounts to worry about.

- Flexible terms: You can choose a term length that makes sense for you and your family.

- Peace of mind: Knowing your family is protected financially can help you sleep better at night.

Cons

- Coverage ends: Once the term is up, your coverage ends. You can renew, but premiums will likely increase.

- No cash value: Unlike whole life, there’s no investment aspect, so you won’t be able to borrow against it or cash it out later.

Like anything in life, it’s all about balance. You’re trading a lower cost and simplicity for a lack of lifetime coverage and cash value. But for many people, that trade-off makes sense, especially if they’re looking for a low-cost life insurance option.

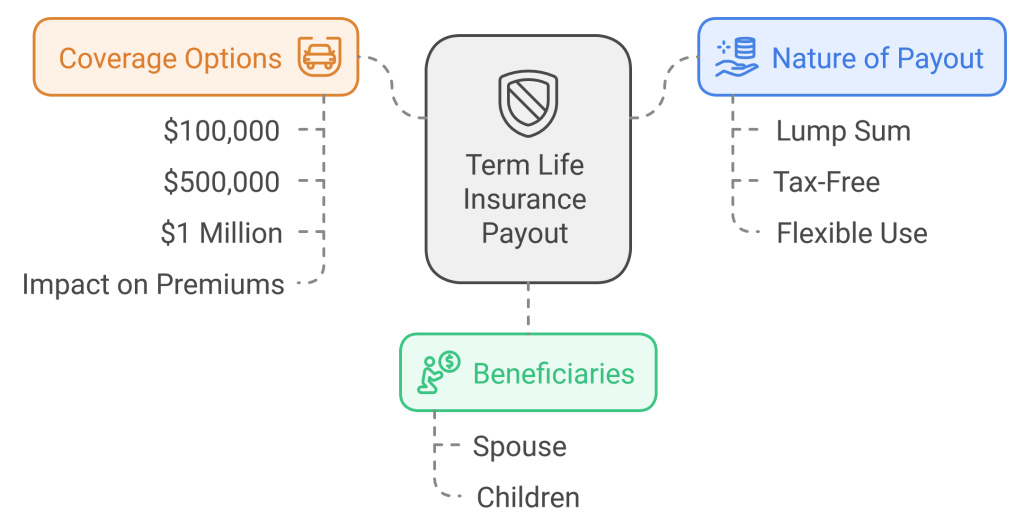

Understanding the Term Life Insurance Payout

Now let’s talk about the term life insurance payout. This is the lump sum that your beneficiaries (usually your spouse or kids) would receive if you were to pass away during the term of the policy. The death benefit payout is typically tax-free, and your beneficiaries can use it however they see fit—whether that’s covering funeral expenses, paying off a mortgage, or even saving for college.

It’s important to know that when you buy a policy, you’ll choose the amount of coverage you want. This could be $100,000, $500,000, or even $1 million—whatever makes sense for your family’s needs. The higher the coverage, the higher the premiums, but it’s all about finding a balance that works for you.

Policyholder Benefits of Term Life Insurance

So what are the perks for you, the policyholder? Aside from peace of mind and protecting your loved ones, there are some cool benefits to term life insurance that might surprise you.

1. Guaranteed Term Life Insurance

Some policies come with a guaranteed term life insurance option. This means that your policy can’t be canceled as long as you’re paying your premiums. It’s like having a safety net that won’t disappear unless you stop paying your dues.

2. No Medical Exam Life Insurance

Not a fan of doctor visits? No problem! Many companies offer no medical exam life insurance, which allows you to get coverage without going through the hassle of a physical exam. This can be a big plus if you’re in a hurry or have some health concerns you don’t want to dig into.

3. Peace of Mind for You and Your Family

The biggest benefit is peace of mind. Life is unpredictable, and while no one likes to think about what would happen if they passed away, having a policy in place means you’ve taken steps to ensure your family’s financial security. You’re not just paying for a piece of paper—you’re paying for the assurance that your loved ones will be okay if the worst happens.

How to Choose the Right Term Life Insurance Plan

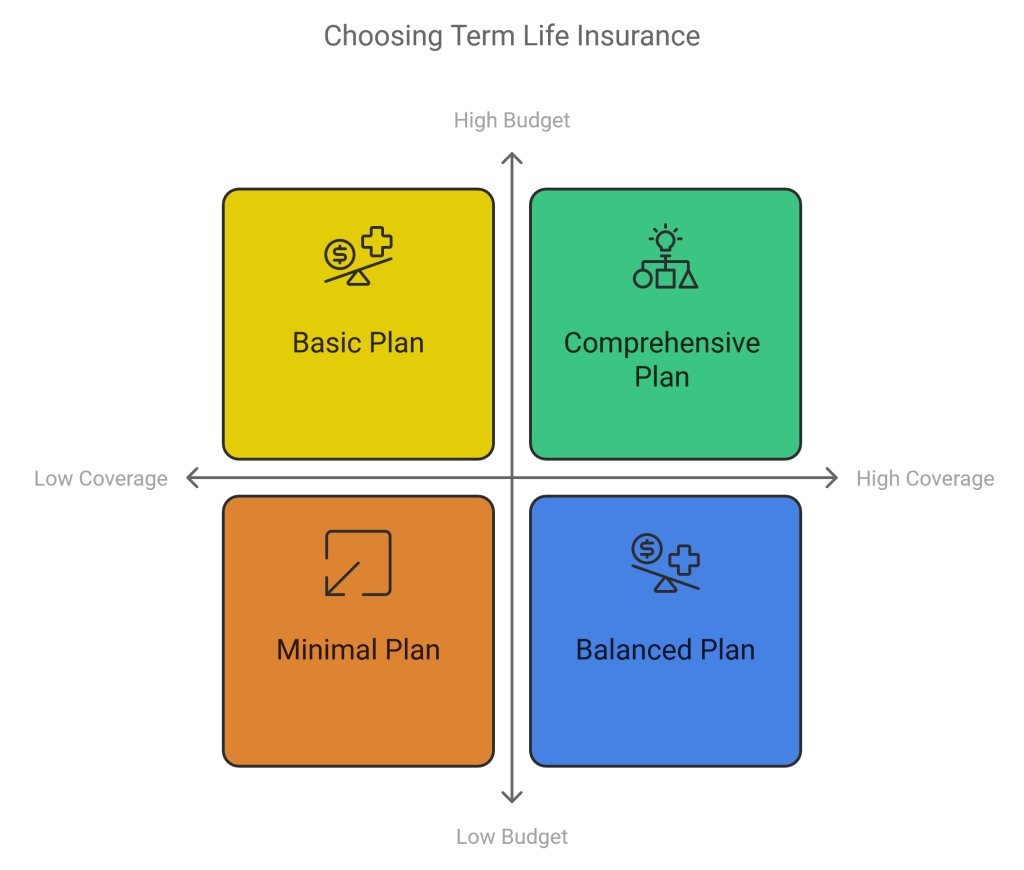

Now that you’re convinced of the benefits, how do you go about choosing the right affordable term life insurance plan? Here are a few things to consider:

1. How Much Coverage Do You Need?

Start by asking yourself how much coverage your family would need to stay financially stable without you. Factor in things like your mortgage, any outstanding debts, funeral expenses, and future expenses like college tuition.

2. How Long Do You Need Coverage?

Do you need coverage until your kids are out of the house? Until your mortgage is paid off? Your term length should match the length of your biggest financial responsibilities.

3. What’s Your Budget?

Look for a policy that fits comfortably within your budget. Term life is generally affordable, but make sure you’re not stretching your finances too thin just to get a larger policy.

Conclusion: The Final Word on Securing Your Family’s Future

In a nutshell, term life insurance might not sound glamorous, but it’s an affordable, practical way to ensure your family’s financial future is secure. From its low-cost life insurance options to its flexibility and simplicity, it’s a great choice for people who want solid coverage without a ton of hassle. At the end of the day, knowing that your loved ones will be protected if something happens to you is priceless.

So, while we all hope for the best, it’s smart to prepare for the unexpected. Term life insurance is the safety net that can give you peace of mind—and honestly, isn’t that worth it?

Besides, isn’t it better to be safe than sorry? Exactly.

1. What is term life insurance, and how does it work?

Term life insurance is a type of policy that provides coverage for a specific period or “term,” usually 10, 20, or 30 years. If the policyholder passes away during the term, the beneficiaries receive a death benefit payout. It’s a low-cost life insurance option designed to offer affordable protection for families.

2. What are the pros and cons of term life insurance?

The pros of term life insurance include affordable premiums and simple coverage. It’s a great choice for those seeking low-cost life insurance options. The downside is that term policies expire after a certain period, and there’s no cash value in life insurance policies like term life. If you outlive the term, the coverage ends without payout.

3. Why should I choose term life insurance over whole life insurance?

If you’re looking for affordable protection for your family, term life insurance is a smart option. It provides coverage options at lower premiums compared to whole life. While whole life insurance builds cash value, term life is more suitable for those who only need coverage for a specific time period. It’s great for people who want a low-cost life insurance option to protect their loved ones.

4. What coverage options are available with term life insurance?

Term life insurance coverage options vary based on your needs. You can choose terms from 10 to 30 years. The policyholder benefits include flexibility in choosing the term length and the amount of the death benefit payout. Some policies also offer a no medical exam life insurance option, making it easier to qualify.

5. How much is the death benefit payout with term life insurance?

The death benefit payout depends on the policy you choose. It can range from tens of thousands to millions of dollars. The amount is predetermined when you purchase the policy, ensuring your life insurance beneficiary is financially secure in case of an unexpected death.

6. Is there any cash value in term life insurance?

No, there is no cash value in life insurance policies like term life. Unlike whole life insurance, term life is strictly for coverage during the chosen period. Once the term ends, the policy expires without accumulating any savings or investment value.

7. Can I get term life insurance without a medical exam?

Yes, many companies offer no medical exam life insurance for term life policies. This makes the application process faster and easier, especially for those who prefer a more simplified way of securing guaranteed term life insurance coverage.

8. What happens when my term life insurance policy expires?

When a term life insurance policy expires, the coverage ends, and there is no payout or cash value. However, many policies allow you to renew or convert the term policy to a permanent one if you still need coverage after the term ends.

9. How much does term life insurance cost compared to whole life insurance?

Life insurance premiums for term life are typically much lower than those for whole life insurance. Term life provides straightforward protection for a set period, making it a low-cost life insurance option. Whole life insurance, on the other hand, offers lifelong coverage with a savings component, leading to higher premiums.

10. Can I name multiple beneficiaries for my term life insurance?

Yes, you can name more than one life insurance beneficiary. This allows you to divide the death benefit payout among different family members or individuals. It’s important to review your policy and make sure your beneficiaries are up to date to reflect your current wishes.

Need More Details about the content? Reach us on our Contact Us page.