When goods set sail across oceans, they embark on a journey fraught with uncertainties. From storms rocking the vessel to unexpected delays, the list of potential risks could make any business owner’s head spin. Enter marine cargo insurance—a specialized form of insurance designed to safeguard those precious shipments as they make their way from point A to point B. In this comprehensive guide, we’re delving deep into what marine cargo insurance is all about, especially within the U.S. context.

What is Marine Cargo Insurance?

The Basics You Need to Know

Marine cargo insurance, at its core, is a type of insurance policy that protects against loss or damage of goods while they’re in transit. Unlike other types of insurance, it’s specifically designed for items that are being shipped over water. But it’s not just restricted to ocean shipping. Marine cargo insurance can also cover air and land transportation as part of a multimodal transit arrangement.

- There are two primary types of marine cargo insurance policies:

- All-risk policies: These provide extensive coverage against a broad range of risks, although certain exclusions can apply.

- Named perils policies: These offer protection against specific risks that are explicitly mentioned in the policy document.

Why is this important? In a world where over 80% of global trade by volume is carried by sea, having marine cargo insurance isn’t just a nice-to-have—it’s a must-have.

Key Points About Marine Cargo Insurance:

- Primary coverage: Includes shipment loss or damage.

- Economical necessity: Protects significant financial investments.

- Versatility: Covers various transportation modes—sea, air, rail, and truck.

For more information on the basics of marine cargo insurance, check out Investopedia’s article on Marine Cargo Insurance.

Understanding what the insurance covers and the different types available gives businesses the cushion they need when the unpredictable happens. So why exactly is marine cargo insurance so critical for businesses, especially those operating out of the United States?

Key Components of Marine Cargo Insurance in the USA

Navigating the insurance realm can sometimes feel like learning a new language, especially when it comes to marine cargo insurance. In the USA, this type of insurance wraps its protective arms around a variety of shipments, whether they’re crossing international waters or moving domestically across states. Here’s a deeper dive into the essential components:

Coverage for International and Domestic Shipments

Marine cargo insurance policies are designed to cater both to international and domestic shipping needs.

- International coverage: Vital for businesses dealing with exports and imports. This section of the policy ensures that goods shipped across international borders are protected against a myriad of potential losses, be they natural disasters, piracy, or handling mishaps.

- Domestic coverage: Provides similar protections but focuses on goods transported within the USA. This can include cargo transported by railroads, trucks, or local vessels.

Typical Exclusions to Be Aware Of

Even the broadest coverage policies come with exclusions. Understanding these is crucial for avoiding costly surprises later on. Typical exclusions in marine cargo insurance include:

- War and war-like activities

- Strikes, riots, and civil commotions

- Deliberate damage by authorities

- Inherent vice or nature of goods

Acknowledging these exceptions helps businesses tailor additional coverage as needed, such as opting for a war risk clause if shipping through conflict zones.

The Process of Claiming Insurance

Should the need arise to file a claim, knowing the standardized process can help streamline what can otherwise be a stressful event. The key steps involve:

- Prompt notification: Notify your insurer immediately upon discovering the loss or damage.

- Documentation: Supply evidence like commercial invoices, packing lists, and a detailed account of the event. Photos can be incredibly helpful too.

- Inspection: Insurers may require inspection and verification of the damage before processing the claim.

The outcome, of course, depends on the clear presentation of events and compliance with all procedural requirements. For a detailed guide on filing a marine insurance claim, you may want to explore this resource from The Balance Small Business.

With a firm understanding of these key components, businesses can better navigate the dynamic world of maritime logistics, ensuring that they’re adequately prepared for whatever the winds might bring their way. When considering marine cargo insurance, the USA presents unique legal frameworks and practices that every business should heed.

How Marine Cargo Insurance Protects Your Business

In the bustling world of global trade, potential pitfalls lurk at every corner. Maritime logistics isn’t just about getting goods from point A to B; it’s about doing so while juggling a spectrum of risks. Marine cargo insurance acts as a vital safety net, ensuring businesses don’t face devastating losses when the unpredictable occurs. Let’s explore how exactly it fortifies businesses involved in shipping.

Risk Management Across Various Modes of Transportation

One of the primary functions of marine cargo insurance is to offer comprehensive risk management, whether goods are traveling by sea, air, or land. The policy adeptly covers:

- Ocean transportation: Safeguards against maritime-specific risks such as storms, cargo jettison, hull damage, and even piracy.

- Air and land transportation: Provides similar protections against theft, accidents, and natural events that can occur during these phases of the journey, ensuring continuous coverage for multimodal transport.

Such versatility allows businesses to manage diverse shipping lines without the constant dread of losing investment due to the numerous shipping risks.

Financial Compensation for Damaged or Lost Goods

A key benefit of marine cargo insurance is its financial shield, covering the cost of goods that are lost or damaged during transit. This includes:

- Total loss: When the entire shipment is lost due to extreme circumstances, such as sinking or total destruction.

- Partial loss: Covers damages or loss of part of the shipment, which can still significantly impact a business’s bottom line.

In cases where specific goods are damaged or stolen, the insurer compensates for those goods, often allowing businesses to replace items swiftly and keep the commercial wheels spinning.

Examples of Common Risks Covered

Certain risks are more prevalent in maritime logistics, and marine cargo insurance typically covers these:

- Theft and pilferage: Cargo can be tempting to thieves, especially if left unsecured.

- Natural calamities: Hurricanes, typhoons, and other acts of nature that wreak havoc on shipping vessels.

- Handling mishaps: Errors during loading or unloading, which can result in damaged goods.

“In 2021, global shipping losses totaled $1.5 billion, a stark reminder of the unforeseen dangers lurking in the shipping industry.” – The International Maritime Organization

Having this sort of backup allows businesses to tackle these risks head-on, without fear of financial ruin. For more insights on how insurance protects against these risks, you might delve into this article from Allianz Global Corporate & Specialty.

Understanding these protective measures demonstrates the true value of marine cargo insurance, particularly for those looking to expand their supply chain both domestically and abroad. It’s a strategic investment that can secure company activities for years to come.

Choosing the Right Marine Cargo Insurance Policy

Navigating the world of marine cargo insurance can feel akin to steering through choppy waters without a compass. The myriad of options, terms, and conditions can be overwhelming. However, choosing the right marine cargo insurance policy is a strategic step that requires careful consideration of several critical factors. Here’s what you need to know to make a well-informed choice.

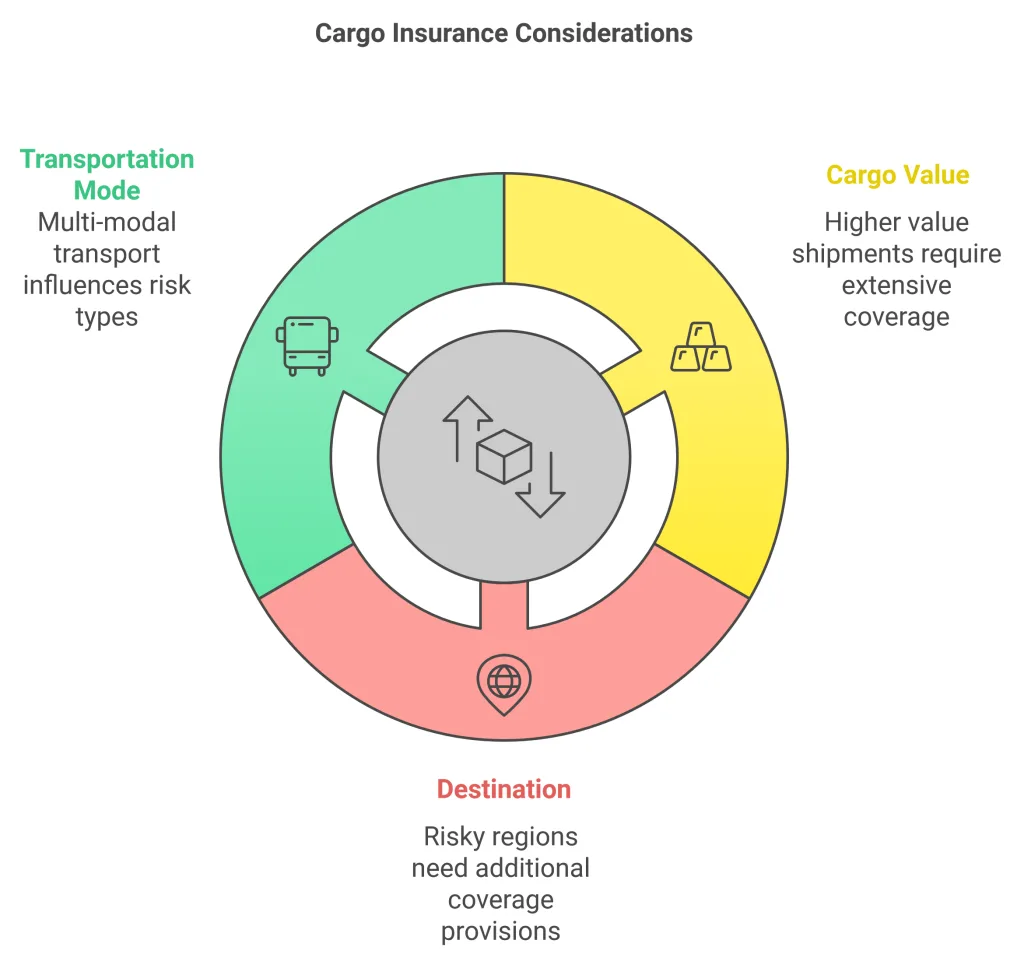

Factors to Consider: Cargo Value, Destination, and Transportation Mode

Selecting the ideal policy starts with assessing the specifics of your shipping operations:

- Cargo Value: Understand the monetary worth of your shipment. Higher value shipments necessitate more extensive coverage to mitigate potential financial losses.

- Destination: Consider the shipment’s final destination. Some regions may present more shipping risks than others, necessitating additional coverage provisions.

- Transportation Mode: Whether your cargo traverses by sea, air, or land—or a combination—will influence the types of risks involved. Ensuring the policy covers multi-modal transport is crucial.

Working with Insurance Brokers and Providers

Collaborating with experienced insurance brokers can simplify the process significantly. Here’s how they can assist:

- Industry Expertise: Brokers possess in-depth knowledge of marine cargo insurance, allowing them to recommend tailored solutions based on specific shipping needs.

- Policy Comparison: They can provide comparative analyses of different offerings, ensuring you secure the most favorable terms and conditions.

- Negotiation Power: Brokers often have the ability to negotiate better rates or terms with insurance providers, ultimately benefiting your bottom line.

Navigating this complex facet of logistics is less daunting with a knowledgeable partner by your side. Find an expert broker who understands the intricacies of your industry via Marine Insurance Brokers Directory.

Customizing a Policy Based on Business Needs

Standard insurance packages may not always suit the distinct needs of all businesses. Customization allows for more appropriate coverage by:

- Adding Clauses: Tailor specific policy clauses, such as war risk or strike coverage, depending on your shipping routes and potential exposures.

- Flexible Terms: Work towards flexible terms, tech advances in tracking shipments can lead to reduced premiums or other benefits.

Developing a bespoke marine cargo insurance package safeguards against myriad vulnerabilities peculiar to your business. It allows you to approach international trade with confidence, knowing full well that you’re covered, come what may.

Opting for marine cargo insurance, therefore, is not just about ticking off a compliance requirement; it’s about crafting a robust risk management strategy. Investing the time and effort upfront can save future headaches, ensuring seamless trade interactions on a global scale.

Legal Considerations and Regulations

When it comes to marine cargo insurance in the USA, understanding the legal landscape is as vital as knowing the terms of your insurance policy. Shipping, after all, is not just a logistical venture but also a legal obligation. Grasping the pertinent regulations can save businesses from heartbreaking fines, disputes, or even forfeiture of goods.

U.S. Federal Regulations Impacting Marine Insurance

In the United States, specific federal laws and regulations govern marine cargo insurance. Awareness of these is crucial for anyone involved in the shipping industry:

- The Marine Insurance Act of 1906: Although a UK law, it’s influential globally and shapes many principles within U.S. marine insurance practices by defining terms like “utmost good faith.”

- Carriage of Goods by Sea Act (COGSA): Restricts the liability of shipowners in the US, specifying cargo damage issues and claims.

- Federal Maritime Commission (FMC): Regulates trade practices, ensuring transparency and fairness in maritime supply chains.

These legal frameworks help ensure that maritime trade is conducted responsibly and ethically. For further reading on these regulations, the Federal Maritime Commission’s resources provide valuable guidance.

International Conventions Affecting Marine Cargo Insurance

Shipping, by its very nature, is global. As such, international conventions play a substantial role in shaping marine cargo insurance policies:

- Hague-Visby Rules: Outline the carrier’s rights and liabilities, serving as a backbone for global shipping regulations.

- Hamburg Rules: Focus on the carrier’s liability in certain regions, offering more coverage compared to its predecessor, the Hague-Visby Rules.

The coordination between national laws and international conventions ensures that marine insurance practices align with global trade standards, aiding in smoother transactions globally.

Documentation and Compliance Requirements

Legalities in marine cargo insurance extend to thorough documentation and compliance. To ensure seamless operations, businesses must focus on:

- Bill of Lading: This legal document acts as a receipt and specifies the goods, details of the journey, and terms of transport.

- Insurance Certificate: Provides proof of insurance, outlining the scope of coverage as agreed upon.

- Import/Export Documentation: Proper documentation is critical for compliance with both U.S. and international laws.

Accurate and efficient handling of these documents not only ensures compliance but also expedites claims processing should any mishaps occur.

By building a robust understanding of these legal considerations, businesses can minimize risk, optimizing their insurance strategies to protect against the myriad unanticipated challenges that come with shipping goods across distances. Knowledge truly is power in this arena. Up next, let me know when you’d like to explore ways to reduce marine cargo insurance costs!

Tips for Reducing Marine Cargo Insurance Costs

Marine cargo insurance, while essential, can represent a significant expense for businesses engaged in shipping operations. However, there are effective strategies you can employ to trim these costs without compromising the quality of coverage. Here are some proactive tips to consider:

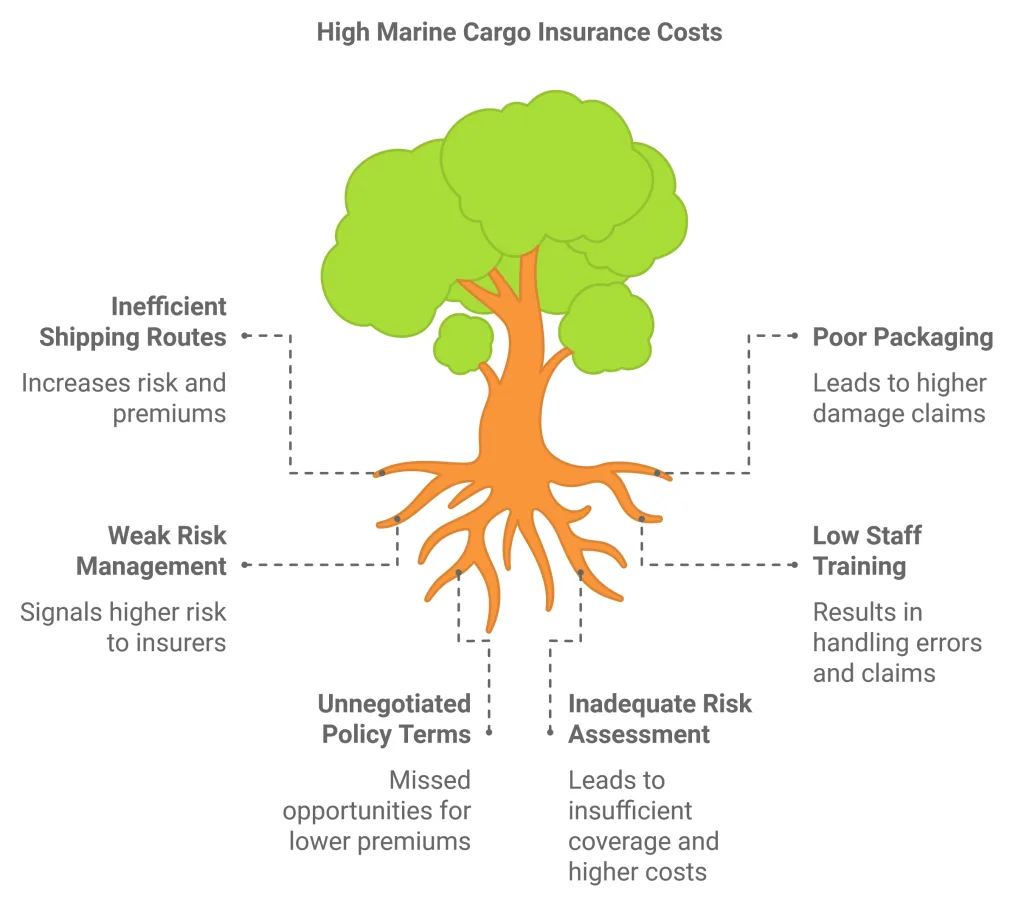

Optimizing Shipping Routes and Packaging

Logistics optimization plays a crucial role in managing insurance premiums:

- Shipping Routes: Selection of safer, more direct shipping routes can reduce the risk of reaching destinations, thereby potentially lowering insurance costs. Utilizing trusted shipping lanes known for their safety records is always a prudent approach.

- Efficient Packaging: Using high-quality, durable packaging materials can minimize the risk of damage in transit. Robust packaging not only protects your goods but can also lead to lowered insurance rates due to the decreased likelihood of claims.

Implementing Risk Management Strategies

Strong risk management practices signal to insurers that you’re a lower-risk client, which can help negotiate better premiums:

- Security Measures: Implementing GPS tracking systems, security seals, and surveillance can deter theft and damage. Insurers often offer discounts for shipments with enhanced security measures.

- Training and Education: Conduct cargo handling training for staff to minimize accidents during loading and unloading. Properly trained staff can reduce the likelihood of claims due to handling errors.

Negotiating Policy Terms and Premiums

Don’t shy away from negotiating the fine print of your policy:

- Deductibles: A higher deductible can sometimes reduce the premium amount significantly. Only opt for this if you’re comfortable covering smaller losses internally.

- Claim History: A clean claim history is a bargaining chip—use it to negotiate better rates. Consistently managing low claim frequency shows insurers that your risk management practices are effective.

Negotiating effectively involves understanding your policy thoroughly. Sit down with your broker or insurer and ensure you leave no stone unturned in pursuit of better terms.

By keeping these methods in mind, businesses can effectively manage their insurance expenses, leaving more resources to navigate other aspects of the competitive maritime industry. These cost-saving tactics, however, should not come at the expense of leaving your assets unprotected. Always ensure that any cost reductions align with your overall risk management strategy.

Top Marine Cargo Insurance Providers in the USA

Choosing the right marine cargo insurance provider is pivotal for ensuring your shipping operations are both secure and cost-effective. While there are numerous firms available, it’s important to select one that aligns with your specific needs, offering the right balance of coverage, cost, and service. Here’s a closer look at some of the top providers in the USA:

Overview of Leading Providers and Their Offerings

- Chubb

- Overview: Chubb is renowned for its extensive global reach and comprehensive coverage options. Their policies cater to businesses of all sizes, offering customizable solutions to fit diverse shipping requirements.

- Key Offerings: All-risk marine policies, global transit coverage, and specialized options for high-value goods.

- Allianz Global Corporate & Specialty (AGCS)

- Overview: Allianz is a stalwart in the insurance sector, known for its robust financial backing and diverse product suite.

- Key Offerings: AGCS provides coverage for international shipments, with specialized protection against evolving risks like cyber threats and environmental liabilities.

- Case Study: Allianz’s prompt action and coverage aided a global electronics company in recovering swiftly from a major transit loss, illustrating their effectiveness in crisis management.

- AXA XL

- Overview: AXA XL is noted for its innovative risk management strategies and personalized service approach. They offer extensive policy options tailored to specific industry needs.

- Key Offerings: Unique risk management tools and advisory services, alongside comprehensive maritime insurance coverage.

Comparing Costs and Customer Service

To make an informed decision, scrutiny of costs and customer satisfaction often involves:

- Premium Comparison: Conduct a detailed analysis of premiums relative to coverage limits. Ensure transparency in any additional fees or hidden costs.

- Customer Feedback: Gauge customer reviews and satisfaction ratings (e.g., JD Power ratings) to assess the quality of service and claims settlement efficiency.

Reviews and Case Studies

- Customer Review for Chubb: “Chubb’s marine insurance policy provided seamless protection for our luxury goods business. Their comprehensive coverage and prompt claims service were outstanding.”

- Case Study – AGCS: A leading textile exporter partnered with AGCS, who tailored a policy that reduced premiums by 15% via risk management adjustments, proving their expertise in crafting cost-efficient solutions.

When evaluating these features, it’s crucial to balance costs with coverage adequacy and service reputation. Trustworthy providers deliver not just coverage, but peace of mind knowing your business is in capable hands. This evaluation process is crucial in finding a provider that suits both your operational and financial objectives.

By understanding the landscape of insurance providers, businesses can find a partner that not only covers their potential losses but actively works alongside them to navigate and mitigate risks in an ever-complex global market.

Conclusion

The world of shipping and logistics is a dynamic landscape full of potential, yet fraught with risks that could derail even the most carefully laid plans. This is where marine cargo insurance steps in, offering a shield of protection for businesses navigating the waters of global trade. As outlined in this guide, understanding the nuances of marine cargo insurance in the USA is not merely beneficial; it is essential.

Key Takeaways:

- Comprehensive Coverage: Marine cargo insurance provides crucial protection against a wide array of risks, from natural disasters and theft to accidents during transit. This coverage is vital for safeguarding your business assets.

- Cost Management: By optimizing shipping operations and engaging in effective risk management practices, businesses can reduce their insurance premiums without sacrificing the quality of coverage.

- Legal Awareness: Navigating the intricate tapestry of U.S. regulations and international conventions ensures your operations remain compliant, preventing potential legal hurdles.

- Choosing the Right Provider: With various top-tier insurance providers offering customizable and strategic coverage packages, selecting the right partner is pivotal. For businesses, this means aligning with providers that understand your unique needs and provide unmatched service and support.

- Embrace Technology and Strategy: Leveraging technology and strategic negotiation can lead to more cost-effective and efficient insurance solutions.

Investing in marine cargo insurance is not just a necessary expenditure—it’s a strategic decision that can protect and even enhance the operational integrity of a business. As global trade continues to evolve, understanding and adapting to these developments increasingly translate into competitive advantages.

For businesses looking to fortify their position in international trade, engaging with the right marine cargo insurance partner is crucial. Not only does it offer peace of mind, but it also represents a commitment to securing a stable and prosperous future.

Ready to take the next step? Consider reaching out to an insurance broker or provider today to begin tailoring a marine cargo insurance plan that aligns with your business goals. Whether you’re a seasoned logistics veteran or new to the world of import/export, robust protection against the unforeseen ensures your business thrives in the complex, interconnected world of global trade.

Thank you for exploring this essential guide to marine cargo insurance in the USA. If you have any more questions or need further information, feel free to reach out. Safe shipping!

FAQ 1: What is marine cargo insurance?

Marine cargo insurance is a type of insurance that protects your goods while they are being shipped. It covers loss or damage during transit over water, and sometimes by air and land too. For more on this, you can explore Investopedia’s detailed explanation.

FAQ 2: Why is marine cargo insurance important for businesses?

This insurance is crucial because it helps protect valuable shipments from risks such as piracy, accidents, and natural disasters. Without it, a business could face significant financial losses if something goes wrong.

FAQ 3: What types of risks does marine cargo insurance cover?

Marine cargo insurance typically covers risks like theft, storm damage, and accidents during shipment. Some policies also protect against piracy and other threats. Check out Allianz’s insights for more information on common risks.

FAQ 4: How do I choose the right marine cargo insurance policy?

Look for a policy based on your cargo value, destination, and transport mode. It’s also important to compare different providers and consider the specific needs of your business. A resource like Marsh’s guide on marine insurance could offer additional guidance.

FAQ 5: What should I consider when selecting a marine cargo insurance provider?

Consider factors like the provider’s reputation, customer reviews, and the comprehensiveness of their coverage. Also, ensure they offer good customer service and claims support.

FAQ 6: How does one file a marine cargo insurance claim?

When filing a claim, notify your insurer immediately, provide necessary documents, and allow for damage inspection if required. The Balance Small Business offers a step-by-step guide on filing claims.

FAQ 7: Can marine cargo insurance be customized for my business needs?

Yes, many insurance providers allow customization of policies. You can add clauses or adjust terms to fit your unique requirements.

FAQ 8: Are there ways to reduce the cost of marine cargo insurance?

Yes, you can lower costs by optimizing your shipping routes, using quality packaging, and improving risk management practices. You might find this overview on reducing insurance costs helpful.

FAQ 9: What legal considerations should I be aware of with marine cargo insurance?

Be aware of U.S. federal regulations, international conventions, and documentation requirements. Understanding these can help you remain compliant and avoid legal issues. The Federal Maritime Commission is a useful resource for up-to-date regulatory information.

FAQ 10: Is marine cargo insurance necessary for my business?

If you ship products, especially overseas, marine cargo insurance is highly recommended. It provides peace of mind and financial protection, ensuring your business can recover quickly from unexpected losses.

Read More: Yacht Insurance in the USA: Your Essential Guide for 2024