Introduction

When it comes to planning a vacation, the fun and excitement often make us forget the more serious aspects, like holiday health insurance. Imagine soaking up the sun on a far-off beach or hiking in the stunning Swiss Alps. Suddenly, you twist an ankle or catch a nasty bug. Without adequate health insurance, such delightful adventures can turn into a financial nightmare. Understanding holiday health insurance is key to protecting yourself while you’re abroad, and that’s exactly what we’ll delve into here.

Understanding Holiday Health Insurance

Definition of Holiday Health Insurance

Holiday health insurance is a specific type of travel insurance designed to cover medical emergencies that may occur while you’re away from your home country. It’s important to note that this isn’t a replacement for regular health insurance; instead, it’s an additional safety net for when you’re exploring the globe.

Importance of Health Insurance While Traveling

Why is this insurance so crucial? Well, outside your country, your usual health insurance might not cover medical expenses. If you’re hospitalized abroad, costs can skyrocket, leaving you in a stressful situation without support. To put it simply, holiday health insurance can be your financial guardian, ensuring you’re not faced with hefty bills during your travels.

Risks of Traveling Without Coverage

Traveling without insurance is, quite frankly, a gamble. You risk everything from minor inconveniences to serious medical emergencies, which can drain your savings. For example, treatment for a fractured leg in some countries can run into the hundreds of thousands. Isn’t it worth avoiding that kind of risk?

Types of Coverage Available

Single-Trip vs. Multi-Trip Policies

Single-trip policies will cover you for one holiday only, while multi-trip policies cover multiple holidays within a year. If you’re planning just one big vacation, a single-trip policy might suit you best. But for frequent travelers, a multi-trip policy often makes more economical sense. Many travelers find a multi-trip policy offers comprehensive travel insurance with added convenience.

Differences Between Domestic and International Insurance

Domestic insurance typically covers you while you travel within your own country, whereas international health insurance steps in when you cross borders. Both have their unique pros and cons, so understanding these can help you pick what’s best for your adventure needs. Remember, your insurance should align with your destination.

Additional Coverage Options

Beyond the basics, you could opt for emergency medical evacuation or repatriation coverage, which means flying you home should you face severe medical risks. You might also want coverage for trip cancellations or loss of belongings. These choices enrich your coverage, ensuring peace of mind.

Key Features to Look For

Medical Coverage Limits and Exclusions

Every policy will have coverage limits that often reflect in the policy premium. Always read through the fine print to understand exclusions—you don’t want any surprises! Some policies might not cover extreme sports injuries or pre-existing conditions without an additional fee. To be fully protected, this is one area you definitely want to scrutinize.

Understanding Policy Terms and Conditions

Insurance jargon can be confusing, but understanding it helps you make informed decisions. Policies vary vastly, so their terms and conditions might affect how your coverage is applied. Spend time reviewing key phrases and ensure your provider explains parts that don’t seem clear.

Importance of 24/7 Assistance Services

Round-the-clock assistance from your insurer is crucial. If you fall ill on the other side of the world, having someone to call for advice and coordination helps avoid hassle and confusion. Look for travel insurance plans promising 24/7 travel assistance services.

How to Choose the Best Policy

Evaluating Insurance Providers

Not all providers are created equal. Start by evaluating their reputation, customer reviews, and financial stability. Reliable insurers have excellent customer service and clear policy details. Visiting independent review sites or asking family and friends for recommendations can be a starting point.

Comparing Quotes and Policy Benefits

Once you’ve shortlisted reputable insurers, it’s time to compare holiday insurance quotes and the benefits they offer. Tools like Compare the Market can help you crunch the numbers and see what suits your budget.

Using Online Tools and Resources

Don’t shy away from using calculators and comparison sites to weigh your options. These resources streamline your search and help simplify complex information, enabling you to focus on crucial aspects, such as hospital treatment or accident coverage.

Common Mistakes to Avoid

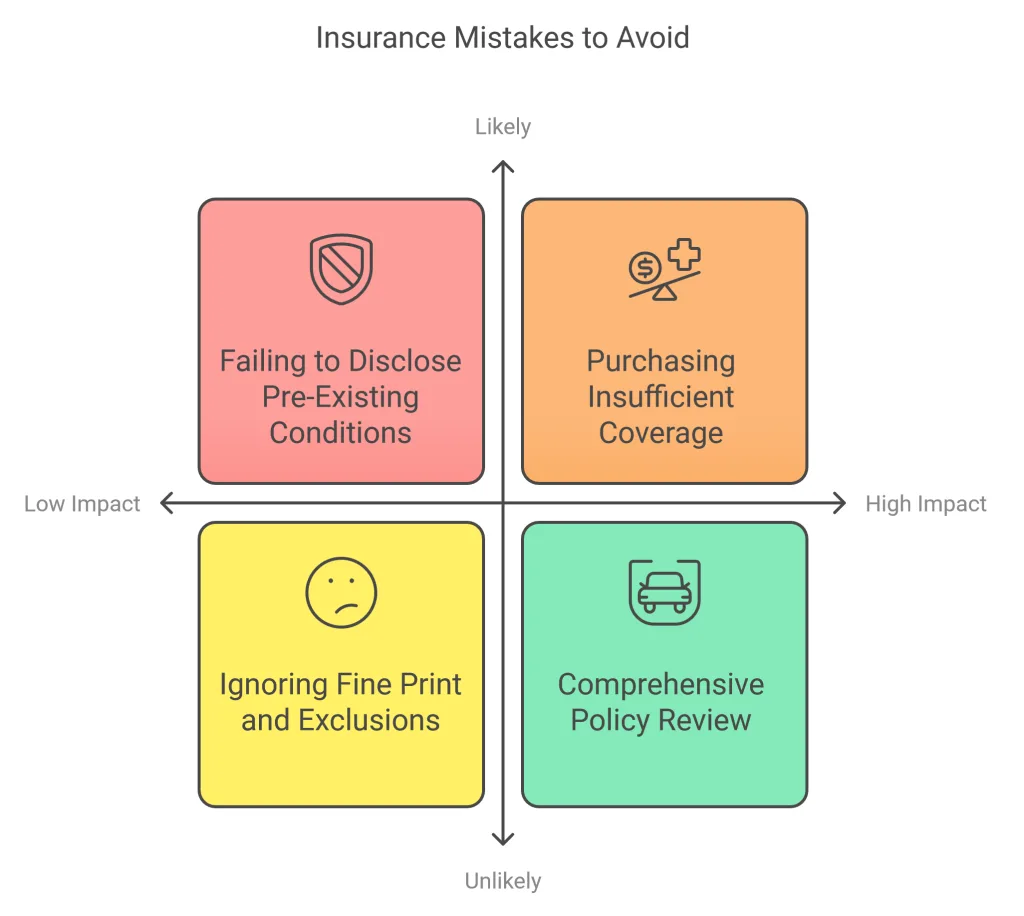

Failing to Disclose Pre-Existing Conditions

Transparency is vital with insurance. Always disclose any pre-existing conditions, as non-disclosure might void your policy. This means sharing relevant health information upfront to ensure your policy truly covers you.

Purchasing Insufficient Coverage

Getting minimal coverage might save a few bucks initially, but it can cost dearly in the event of an accident or emergency. It’s wise to get a bit more than you think you might need to cover unexpected occurrences.

Ignoring the Fine Print and Exclusions

As tedious as it may sound, read the entire policy document before signing. Being aware of exclusions and coverage specifics can prevent disappointments.

Making a Claim: What You Need to Know

Step-by-Step Claim Process Explanation

Acquaint yourself with the claims process before you actually need it. Most insurance policies have a detailed claim process, usually involving a simple document submission. Knowing this well ahead eases stress when filing a claim.

Documents Required for Successful Claims

Keep all necessary documents handy: policy details, medical records, receipts, etc. These are essential for substantiating your claims. Ensure they’re meticulously filled out to avoid unnecessary delays.

Tips for Avoiding Claim Rejections

To avoid rejection, ensure complete accuracy in your submissions and answer every question truthfully. False or incomplete information can stall your application or get it denied altogether.

Conclusion

In a world filled with unpredictable moments, secure holiday health insurance offers a consistent peace of mind. As this guide has highlighted, understanding the intricacies of choosing the right policy entails comparing types of coverage, and dissecting different benefits offered by insurers.

Your next vacation should be an adventure filled with new cultures and gastronomy—not a stressful hunt for medical assistance. Prioritize your holiday health insurance to ensure your experiences abroad remain delightful and hassle-free. So, ready to explore with a safety net? Make holiday health insurance your next travel companion and let every journey be the joyful, jolt-free adventure it should be.

Additional Resources:

By investing some time and effort into understanding holiday health insurance, you’re not only investing in your health but also in ensuring that your travel adventures remain as breathtaking and exhilarating as you envision them to be. Now, go explore the world with confidence!

Frequently Asked Questions about Holiday Health Insurance

What is holiday health insurance and why do I need it?

Holiday health insurance is a type of insurance that covers medical emergencies while traveling. It’s essential because regular health insurance often doesn’t work abroad, meaning you could end up with huge medical bills if you get sick or injured.

How is holiday health insurance different from regular travel insurance?

Holiday health insurance specifically covers medical emergencies. Regular travel insurance may also cover things like lost luggage, trip cancellations, and other travel mishaps. Combine them for full coverage while traveling.

Can I use my domestic health insurance when traveling internationally?

Holiday health insurance specifically covers medical emergencies. Regular travel insurance may also cover things like lost luggage, trip cancellations, and other travel mishaps. Combine them for full coverage while traveling.

What should I look for in a good holiday health insurance policy?

Check coverage limits, exclusions, and if it covers emergencies or risky activities you plan on. Also, make sure there is 24/7 emergency assistance. Compare holiday insurance plans for the best fit.

Is a single-trip policy better than a multi-trip policy?

It depends. If you travel just once or twice a year, a single-trip policy is fine. If you take multiple trips, a multi-trip policy can save money and offers more convenience with comprehensive travel insurance.

Will holiday health insurance cover existing medical conditions?

Some policies cover pre-existing conditions, but you must disclose them when buying the policy. Otherwise, claims may be denied.

How do I make a claim if something happens during my trip?

First, contact your insurer immediately. Gather necessary documents like medical reports and receipts. Follow their step-by-step claim process for a smooth experience.

What if I need to be evacuated due to a medical emergency? Does insurance cover that?

Many policies offer emergency medical evacuation or repatriation. Always check if this is included in your policy, especially if traveling to remote areas.

Do I need holiday health insurance if I am traveling domestically?

It depends on your regular health insurance coverage. Some choose to buy it for extra peace of mind during domestic travels, especially if they have activities planned that carry risks.

How much does holiday health insurance usually cost?

Costs vary based on age, destination, trip duration, and coverage choices. Use online tools and sites like Compare the Market to get quotes and find the best option for your budget.

These FAQs should help clear up common questions about holiday health insurance and guide you toward making an informed choice for your next travel adventure!

Need More Details about the Holiday Health Insurance? Reach us on our Contact Us page.