Introduction

Home insurance offers critical financial protection in times of need, covering everything from natural disasters to accidental damage. However, filing a claim doesn’t always guarantee approval. Many homeowners face the frustrating reality of having their home insurance claims denied, often without fully understanding why. This article will explore the common reasons for home insurance claim denial and provide actionable steps you can take to avoid home insurance claim rejection. We’ll also walk through what to do if your home insurance claim is denied, as well as your legal rights and options for appealing the decision.

Filing a home insurance claim should provide peace of mind, but common mistakes leading to home insurance claim denial can derail the process. Let’s dive deeper into these pitfalls and how to prevent them from happening to you.

Common Reasons Why Home Insurance Claims Get Denied

- Lack of Maintenance or Neglect

Homeowners are expected to properly maintain their homes. Insurance companies typically deny claims if the damage results from neglect or deferred maintenance. For example, if your roof leaks because of wear and tear, rather than from a covered peril like a storm, your claim is likely to be rejected.Tip: Regularly inspect and maintain your home to avoid this common issue. Insurance companies expect you to take reasonable care of your property. - Insufficient Documentation

Claims are frequently denied due to insufficient or incorrect documentation. Failing to provide necessary photos, receipts, or detailed reports makes it difficult for insurers to process your claim.Tip: Keep a comprehensive record of your possessions and any repairs made to your home. If you experience damage, document everything as soon as possible. - Missed Deadlines

Many homeowners miss claim deadlines, which can result in an automatic denial. Each policy has strict time frames for filing claims and submitting required information.Tip: Always review your insurance policy for the specific deadlines and file claims as promptly as possible after an incident occurs. - Policy Exclusions

Every home insurance policy has exclusions—types of damage or incidents that are not covered. For instance, flood damage is typically excluded unless you have a separate flood insurance policy.Tip: Review your policy carefully and consider purchasing additional coverage for common risks in your area, such as earthquakes or floods. - Unreported Improvements

If you’ve made significant improvements to your home without informing your insurer, they may deny claims related to those improvements. For example, if you added an expensive extension without updating your policy, damage to that section might not be covered.Tip: Keep your insurance company updated with any major changes to your home to ensure you’re fully covered.

How to Avoid Home Insurance Claim Denial

Now that we’ve covered the most frequent home insurance claim rejection causes, let’s explore how you can reduce the chances of your claim being denied.

- Read Your Policy Thoroughly

Understanding what is and isn’t covered is essential to avoiding unexpected denials. Insurance policies can be dense, but taking the time to read through and ask questions if needed can save you significant headaches later. - Keep a Home Inventory

Maintain an up-to-date list of your belongings, complete with receipts and photographs where possible. This not only speeds up the claim process but also helps in cases of disputes. - Report Claims Immediately

Don’t delay. Many policies have strict timelines for filing claims. Reporting damage immediately ensures you’re within the window allowed by your insurer. - Maintain Your Property

Regular home maintenance is key to avoiding damage that might not be covered by insurance. Roof repairs, plumbing updates, and HVAC maintenance all play a role in keeping your home insurable. - Be Honest on Your Application

Providing false information when applying for insurance can lead to claim denials later. Be upfront about past claims, home improvements, and risk factors.

What to Do If Your Home Insurance Claim Is Denied

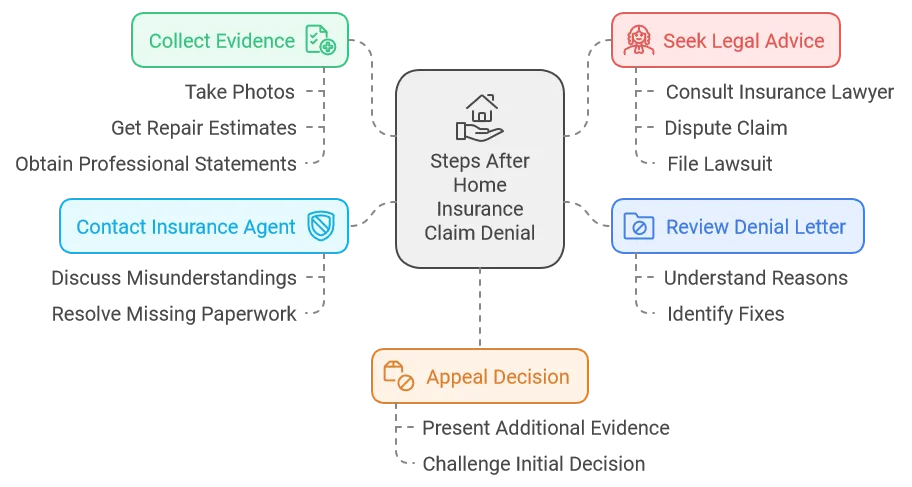

If your home insurance claim is denied, don’t panic. You have several options available to you, including appealing the denial and seeking legal advice. Here are the steps to take after receiving a denial notice:

- Review the Denial Letter

The first thing you should do is carefully read the denial letter from your insurer. This document will outline the reasons for the denial and offer insight into whether you can fix the issue. - Collect Additional Evidence

If your claim was denied due to insufficient evidence, gather more documentation. Take photos, get repair estimates, or obtain statements from professionals who can support your claim. - Contact Your Insurance Agent

Reach out to your agent to discuss the denial. Sometimes claims are rejected due to misunderstandings or missing paperwork. Your agent can often help you resolve these issues. - Appeal the Decision

If you believe your claim was wrongly denied, most insurance companies have an appeal process. This allows you to present additional evidence or challenge the initial decision. - Seek Legal Advice

In cases where the denial seems unjust, you may want to consult with an attorney who specializes in insurance claims. A lawyer can guide you through the process of disputing the claim or even filing a lawsuit, if necessary.

How to Appeal a Denied Home Insurance Claim

Appealing a denied claim can feel overwhelming, but knowing the process makes it more manageable. Here are the key steps in appealing a rejected claim:

- Understand the Reason for Denial

Before proceeding, fully understand why your claim was denied. Some common reasons for denial include lack of coverage, incomplete documentation, or filing errors. - Gather Supporting Documents

Collect all necessary documents that can support your appeal. This may include repair estimates, witness statements, and evidence of maintenance. - Write a Formal Appeal Letter

Draft a clear, professional letter to your insurer explaining why you believe the claim should be reconsidered. Attach all supporting documents and clearly reference your policy details. - Follow Up

Don’t hesitate to follow up with your insurer after submitting the appeal. Persistence often pays off, and timely communication can help expedite the process.

Conclusion

Understanding the common reasons for home insurance claim denial is crucial in preventing claim rejection. By maintaining your property, keeping accurate records, and fully understanding your policy, you can significantly reduce your chances of having a claim denied. In the unfortunate event that your claim is rejected, follow the appeal process and exercise your legal rights. Remember, proactive steps can make all the difference in ensuring a smooth and successful claims experience.Frequently Asked Questions (FAQs)

1. Why do home insurance claims get denied?

Home insurance claims are often denied due to insufficient coverage, neglect, or missed deadlines.

2. Can I challenge a denied home insurance claim?

Yes, most insurers allow you to appeal a denied claim by providing additional evidence and documentation.

3. What are the most common reasons for home insurance claim denial?

Common reasons include lack of maintenance, policy exclusions, and filing claims outside of the allowed timeframe.

4. How do I avoid home insurance claim rejection?

Keep your home well-maintained, document everything, and understand your policy’s specific coverage and exclusions.

5. What should I do if my home insurance claim is denied?

Review the denial letter, gather additional evidence, and consider appealing the decision or seeking legal advice.

6. Can you appeal a home insurance claim denial?

Yes, you can appeal. Write a formal letter explaining why you believe the claim should be approved, and include all relevant documentation.

7. How often are home insurance claims denied?

Denial rates can vary, but it’s estimated that around 10% of home insurance claims are denied.

8. What percentage of home insurance claims are denied due to paperwork errors?

Paperwork errors account for a significant percentage of denied claims, which is why thorough documentation is essential.

9. How do I prevent home insurance claim denial in 2024?

To avoid claim rejection in 2024, ensure you maintain your home, file promptly, and thoroughly document all damages.

10. What causes home insurance claims to be denied?

Claims can be denied for various reasons, including lack of coverage, neglect, insufficient documentation, or failing to meet deadlines.

Need More Details about the home insurance claims? Reach us on our Contact Us page.